What Peak Gold, Interest Rates And Current Geopolitical Tensions Mean For Gold in 2018

– Peak gold will be a major driver, gold over $5,000/oz ‘not beyond the realms of possibility’

– Relationship between interest rates and inflation are one of the key catalysts for price

– Geopolitical uncertainty will continue to play a key role in determining the price of gold

– What happens when the unstoppable force of robust global demand for gold meets the immovable object of a small, finite, rare and dwinding supply of physical gold?

The editors over at The Daily Reckoning have taken some time to speak to gold market experts about their thoughts and expectations for the precious metal in the new year.

There were two main catalysts mentioned by both the experts and the editors; the relationship between interest rates and inflation, and mounting geopolitical tensions.

Within these factors peak gold was of particular interest. Goldcore’s Mark O’Byrne told the Daily Reckoning:

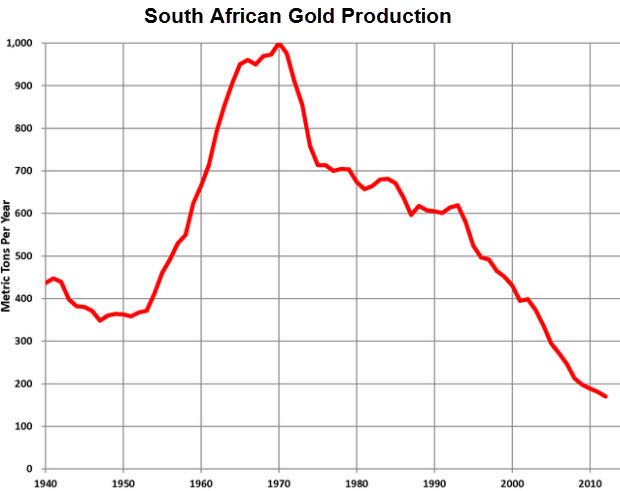

“We are on the cusp of peak gold production…Gold production in South Africa has already fallen over 75% and it is the canary in the gold mine so to speak.

All the data is suggesting this and leading people in the gold mining industry itself to say we are on the verge of a gold peak.”

According to Mark, “Uber-bull predictions of gold at over $5,000 per ounce are not beyond the realms of possibility…”

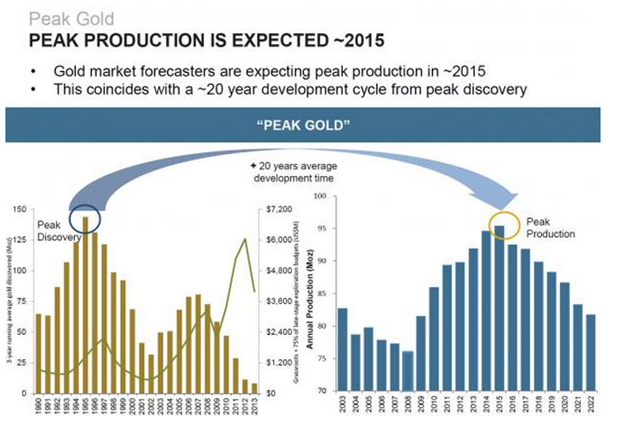

Peak gold has been an area of rising interest in recent years. The risk of falling gold production and a consequent reduction in supply are issues the mainstream are becoming slowly aware of. Some are already asking whether 2015 or 2016 marked the year of peak gold production.

As Mark mentioned in his interview with The Daily Reckoning the gold supply from South Africa has seen a dramatic fall of late. In 1970 South Africa produced over 1,000 tonnes of gold but this has since fallen to below 250 tonnes in recent years (see chart above).

Levels this low have not been seen since 1922, a year which did not have the advantage of the massive technological advances of recent years and more intensive mining practices.

As Mark asked at the beginning of the year: What happens when the unstoppable force of robust global demand for gold meets the immovable object of a small, finite, rare and dwinding supply of physical gold?

Below we bring you the rest of the Daily Reckoning’s piece entitled ‘Gold round-up: what our editors think about the yellow metal‘

The key to understanding gold price

Let’s start with our growth expert, Sean Keyes, who thinks the key to understanding gold, and predicting future price hikes, lies in interest rates and inflation:

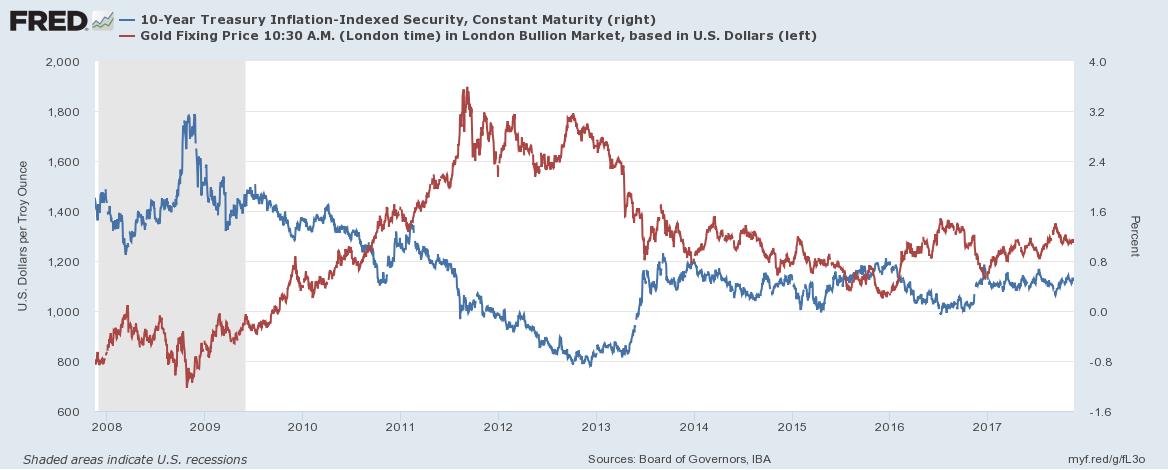

“When real rates are high gold goes down. Then real rates are low it goes up. It doesn’t really matter what’s causing real rates to change – it could be inflation or interest rates, or both together – what matters is the combination of the two.”

As Sean says here, in the past, the real interest rate has mirrored the gold price.

This, according to Sean, is the green light investors should look out for when trying to spot an incline in price.

David Stevenson agrees.

He kicked off the gold theme last week by deconstructing the popular view that interest rates could be harmful for bullion, and that inflation alone would improve value.

Both, according to David, are only partly right.

He reckons the true driver of the gold price is US real interest rate, saying:

Gold only comes under pressure when nominal rates rise faster than increases in the consumer price index.

Further, before the great financial crisis that began a decade ago, the real interest rate was also viewed as being roughly equivalent to the real economic growth rate.

Now the US economy has been expanding someway faster than 0.5% in recent years. For example, 2017 Q3 annualised real growth was 3%.

So you see, according to David, negative interest rates could be a key facilitator for a rise in gold price.

But why would negative interest rates be a problem now?

In David’s view, the post-financial crisis is “very long in the tooth,” and at this point, recession looks more likely than inflation.

An obvious catalyst

So, with stock prices and junk bonds appearing more vulnerable to significant falls, central banks are likely to rely on negative interest rates to patch-up the wounds.

And this could be excellent news for the gold price:

In the next financial crisis, central banks could engineer even larger negative numbers that could lead to a gold price well in excess of $2,000 per ounce.

Gold’s time to shine

You’ve probably heard of Jim Rickards before.

Famously bullish about gold, Jim recently stated in an article for The Daily Reckoning that:

“The crisis in North Korea is not getting any better; it’s actually getting worse. Syria, Iran and the South China Sea are additional flashpoints. The headlines may fade in any given week, but geopolitical shocks will return when least expected and send gold soaring in a flight to safety.

Finally, the Fed will not raise rates in December, contrary to market expectations.

As market probabilities catch up with reality, the dollar will sink and gold will rally.”

You can read Jim’s full article here.

Should these events play out, investors may flock to gold as a safe-haven asset, and Jim’s $10,000 per ounce prediction could become a reality a lot sooner than anticipated.

Related reading

Peak Gold – Biggest Gold Story Not Being Reported

An Interview with GoldCore Founder, Mark O’Byrne

China, Russia Alliance Deepens Against American Overstretch

Gold Could Surge To $8,000/oz On Negative Interest Rates – Lassonde

News and Commentary

Gold prices little changed as dollar holds steady on tax bill hopes (Reuters.com)

Asia Stocks Mixed as Tax Vote Awaits; Yields Climb (Bloomberg.com)

U.S. stocks retreat from records (MarketWatch.com)

Single-family housing starts, permits hit 10-year high (Reuters.com)

Where Janet Yellen has fallen short as head of the Federal Reserve (MarketWatch.com)

Central banks, trade and bubbles threaten the 2018 status quo (Reuters.com)

Gold Prices (LBMA AM)

20 Dec: USD 1,265.95, GBP 944.27 & EUR 1,068.21 per ounce

19 Dec: USD 1,263.10, GBP 944.93 & EUR 1,070.10 per ounce

18 Dec: USD 1,258.65, GBP 943.11 & EUR 1,067.71 per ounce

15 Dec: USD 1,257.25, GBP 937.41 & EUR 1,065.52 per ounce

14 Dec: USD 1,255.60, GBP 935.67 & EUR 1,062.49 per ounce

13 Dec: USD 1,241.60, GBP 929.96 & EUR 1,056.97 per ounce

12 Dec: USD 1,243.40, GBP 933.92 & EUR 1,056.27 per ounce

Silver Prices (LBMA)

20 Dec: USD 16.19, GBP 12.09 & EUR 13.67 per ounce

19 Dec: USD 16.16, GBP 12.08 & EUR 13.68 per ounce

18 Dec: USD 16.09, GBP 12.04 & EUR 13.64 per ounce

15 Dec: USD 15.99, GBP 11.93 & EUR 13.55 per ounce

14 Dec: USD 16.01, GBP 11.92 & EUR 13.54 per ounce

13 Dec: USD 15.71, GBP 11.76 & EUR 13.38 per ounce

12 Dec: USD 15.78, GBP 11.82 & EUR 13.40 per ounce

Recent Market Updates

– New Rules For Cross-Border Cash and Gold Bullion Movements

– ‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

– WGC: 2018 Set To Be A Positive Year For Price of Gold and Investors

– Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

– UK Stagflation Risk As Inflation Hits 3.1% and House Prices Fall

– Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

– Bitcoin – Plan Your Exit Strategy Now – Maybe With Gold

– Gold Demand Increases Along with Uncertainty Thanks to Trump, Brexit and North Korea

– UK Pensions Risk – Time to Rebalance and Allocate to Cash and Gold

– Bailins Coming In EU – 114 Italian Banks Have NP Loans Exceeding Tangible Assets

– Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries

– An Interview with GoldCore Founder, Mark O’Byrne

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

The post What Peak Gold, Interest Rates And Current Geopolitical Tensions Mean For Gold in 2018 appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.