While the silver price gained over 10 percent in the first quarter of the year, Q2 was a different story. The white metal dropped about 13 percent in the second quarter, andwas below $16 per ounce as of Thursday (July 13).

In a note, Capital Economics economistSimona Gambarini explains that precious metal has been trending downwardsince mid-April, noting that speculators appear to beturning increasingly negative on both gold and silver. The number of short contracts in the silver futures market has increased by over 150 percent since the start of the year, the highest level on record.

Read on for a more in-depth look at themain factors that impacted the silver market in the secondquarter of 2017. This silver price update also includes an overview of what investors should watch out for heading into Q3.

Silver price update: Demand

Part of the reason silver fell in Q2 is that it is considered an insurance policy in times of geopolitical uncertainty. Speaking to the Investing News Network via phone, Johann Wiebe of Thomson Reuters GFMS explained that in 2017 more modest governments have been formed in Europe. That’s in contrast to 2016, when when there was much concern about the rise of Euro-skepticism in countries like France, the Netherlands and Germany.

Wiebe also said the silver price has been affected by rising interest rates in the US. He noted thateverybody is eyeing the US Federal Reserve, which raised interest rates in March and Juneof this year. Wiebe said he expects a pause, at least for this year, in the rate hiking cycle.

Capital Economics sees the Fed’slast rate hike occuringin Q1 2019. Gambarini said the prospect of higher interest rates is likely to weigh on investment demand, which is expected to fall by 3 percent in 2017 as a result of the tighter US monetary policy environment.

Indeed, she notes that silver coin sales in the US and Australia, two of the largest markets, were 49 percent lower in the first half of 2017 compared to the same period in 2016. Similarly, physically backed silver ETF holdings haveincreased by 24 million ounces so far this year – that’s about half the amountadded over the same period in 2016.

In contrast, industrial demand for silver is on the rise.Wiebe said the solar sector continues to be the bright star of the silver industry, noting that the metal is increasingly being usedin solar panels to help the world transition from fossil fuels to green energy generation. Demandfor silver in industrial applications is expected to grow by about 1 percent year-over-year.

Silver price update: Supply

Silver is primarily mined as a by-productat gold, zinc and copper operations.Oversupply has been an issue in the silver market for the past 10 years, Gambarini explains, but notes that production cuts have begun to take their toll on mine supply.

Global silver mine production fell by 1 percent in 2016, with output from top producers Mexico and Peru sinking4 and 3 percent year-on-year from January to April, respectively. The fall in production was due to flooding in Peru, workers striking in Mexico and exhaustion of reserves.

Connect with our Featured Silver Stocks to receive the latest news and investor presentations.

Wiebe said production will continue to decrease, and added that capital costs are an issue in increasing production. In fact, output from the 14largest silver producers, which together accountfor over 40 percent of total mine supply, was down by over 5 percent year-over-year in Q1 2017. Capital Economics expects a 3-percent fall in output in 2017.

However, Wiebe said Peru is expanding production through Bear Creek Mining’s (TSXV:BCM) Corani project, which has an estimated 18-year mine life and willbe capable of producing 8.4 million ounces of silver per year. Bear Creek is applying for a construction permit this year.

Elsewhere, production at Tahoe Resources’ (TSX:THO,NYSE:TAHO) Escobal mine in Guatemala has come to a halt on the suspension of the firm’s mining license by the country’s highest court. Escobal is one of the world’s largest silver mines.

Silver price update: What’s ahead?

Wiebe said investors seem to be risk prone at the moment, which is being reflected in continued bullish sentiment on various stock exchanges. However, he also said that every day there is a new record in the market the next correction comes closer.

We are due for the next market correction, and considering market cycles, it would not be surprising for the US to have a recession again, he commented.

Although the US labor market looks strong with unemployment at 4.6 percent, the labor force participation ratestands at a historic low of 62.7 percent, down from 66 percent before the 2007 to 2009 recession. Those numbers mean lot of people are not looking for work. Therefore, the labor market, and with that the economic sentiment in the US, might look strong, but it’s not that strong if you are willing to look under the surface, Wiebe explained.

Despite market weakness, GFMS predicts that silver will reach an average of $17 in Q3 and approximately $18 in Q4. Looking ahead to 2019 Wiebe ismore optimistic, and anticipates that silver will trade above $19.

Capital Economics released a more modest prediction of $15 by the end of 2017, with a recovery to about $16 by the end of 2018.

Forecasting silver prices remains a difficult task. Wiebe noted that silver is often called the devil’s metal because it has historically been more is volatile than gold and tends to track gold’s price direction with a certain lag. Gold might move first and silver will follow, but quite often after a certain period it will overshoot gold’s initial price direction to the upside as well as to the downside.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.

This article is updated quarterly. Please scroll to the top for the most recent information.

Silver Price Update: Q1 2017 in Review

By Priscila Barrera, April 6, 2017

The silver price gained more than 10 percent in the first quarter of the year, fueled by worldwide economic and political uncertainty.

Donald Trump’s presidential election win has been a key driver of that uncertainty. Concerns about what he may or may not do have sent investors rushing to buy precious metals like gold and silver as safe-haven assets. Many analysts believe that silver in particular is now on track for another positive quarter, and will continue to perform well in the coming years.

With that in mind, here’s an overview of the main factors that impacted the silver market in the first quarter of 2017, and a look at what investors should watch out for heading into Q2.

Silver price update: Q1 overview

Silver has been surging since the second half of 2016. Its only significant drop during Q1 2017 came in March before the US Federal Reserve announced its second rate hike in three months; however, once the hike actually came, the silver price rebounded.

The white metal has outperformed gold so far this year – according to Bloomberg, the gold-silver ratio rose to 71 on March 14, the most in two months, and above the average of 62 seen in the last decade. That shows there’s potential for silver to appreciate further compared to gold.

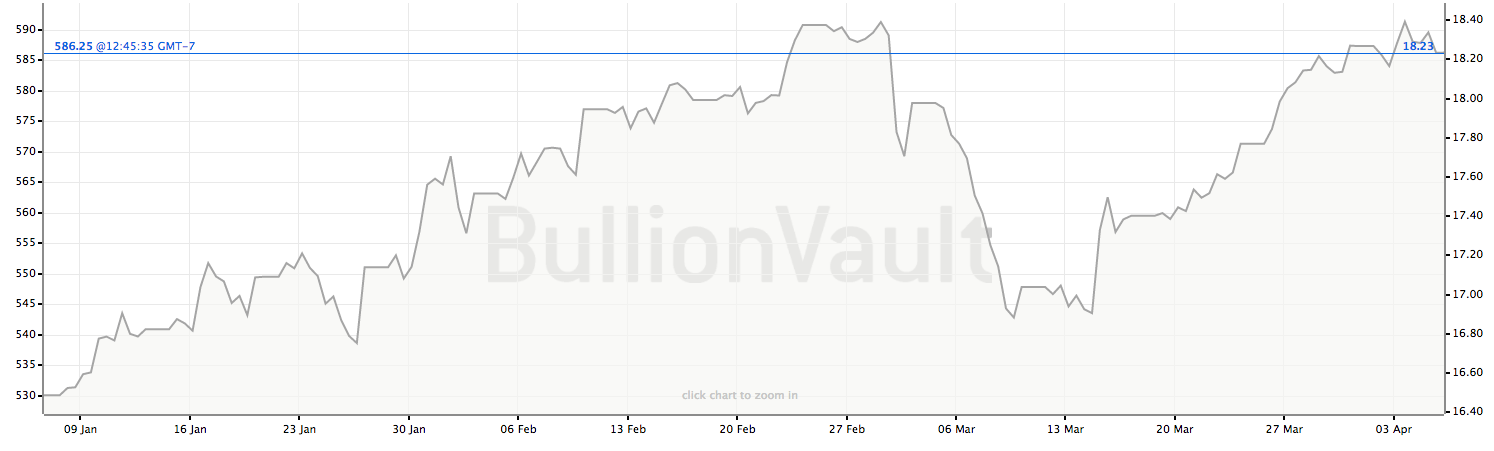

The chart below shows how the silver price performed in the first quarter of 2017:

Chart via BullionVault.

Silver hit its highest point in 2017 on March 1, when it briefly reached $18.39 per ounce, a three-month high. It reachedits lowest point of the year on January 1, when it sank to $15.91; it was pushed down that day by a higher US dollar and by the Fed’s decision to increase interest rates.

The silver price finished the quarter at $18.27, and as mentioned, many market watchers believe that further gains could be in store later in 2017. In particular, instability caused by Trump and upcoming European elections could improve sentiment among institutional investors and push the metal higher.

We expect that the factors that buoyed institutional silver investment over much of 2016, and have carried over into the early months of 2017, will remain relevant for the remainder of this year, said Michael DiRienzo, the executive director at the Silver Institute.

Silver price update: Supply and demand

The silver market recorded its fourth consecutive annual deficit in 2016, supported by ETF trust fund investment and strong stockpiling in exchange-approved warehouses.

Another deficit could be in store this year. According to Capital Economics, silver mine output is expected to fall more than last year’s 2 percent. We estimate that silver mine supply could fall by 4 percent in 2017, Simona Gambarini, a commodities economist at the firm, said via email.

Last year, silver mine production dropped in large part due to production cuts from major diversified miners like BHP Billiton (NYSE:BHP,LSE:BLT,ASX:BHP), Nyrstar (EBR:NYR) and Glencore (LSE:GLEN), all of which produce silver as a by-product.

Only around 30 percent of annual silver supply comes from primary silver mines. More than a third is produced at lead/zinc operations, while a further 20 percent comes from copper mines.

Meanwhile, silver demand should remain strong. Thoughdemand from the industrial sector is seen staying flat – though still near a record -other areas will thrive. Use in solar panels, electronics, batteries, jewelry, chemical process catalysts, and other manufactured products will remain strong, said Jeffrey Christian, managing director of CPM Group.

Connect with our Featured Silver Stocks to receive the latest news and investor presentations.

Silver price update: What’s ahead?

As the second quarter of the year begins, investors interested in the silver market should pay attention to a number of factors that could have a short-term impact on the precious metal’s price.

Looking at how gold performs will be essential. It is likely that the positive momentum in gold prices will spill over to silver prices as well, Georgette Boele, ABN AMRO Group(AMS:ABN) commodities strategist, said in a note. Moreover, further upward momentum in the US economy will probably result in higher industrial demand for silver.

Similarly, Robin Bahr, a metals analyst at Societe Generale (EPA:GLE), said last month: [w]e expect silver prices to remain steady in 2017, as any safe-harbor demand on the back of appetite for gold is likely to be bolstered by a modest rise in industrial usage.

Investors should also watch for any further rate hikes from the Fed. In particular, it will be important to notehow they impact the US dollar, as a higher greenback could pressure silver.

Finally, investors should keep an eye on political events worldwide. European elections, the Brexit process and Trump’s upcoming policies could boost silver prices at any time.

Capital Economics sees the silver price remaining fairly steady over the next few years. Its silver price forecast is $14.50 by the end of 2017 and $17.50 by the end of 2018.

Similarly, panelists at FocusEconomics see silver falling marginally from the current level in the coming quarters, before rising next year. The most bearish forecast for the second quarter comes from Emirates NBD, which is calling for a price of $15.30; meanwhile, RBC Capital Markets is the most bullish with a forecast of $19.30.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

The post Silver Price Update: Q2 2017 in Review appeared first on Investing News Network.

alt=”silver free industry report”>

alt=”silver free industry report”>

Leave A Comment

You must be logged in to post a comment.