The silver price made gains of 0.21 percent in the first quarter of the year, supported by a weaker US dollar and inflation.

While gains were initially offset by expectations over a US Federal Reserve’s interest rate hike, silver headed in an upward motion in March after the hike became official.

In addition to the factors mentioned above, analysts also predict that silver will post a supply deficit this year, propping up prices.

Read on for an overview of the factors that impacted the silver market in Q1, plus a look at what investors should watch out for in the next few months of the year.

Silver price update: Q1 overview

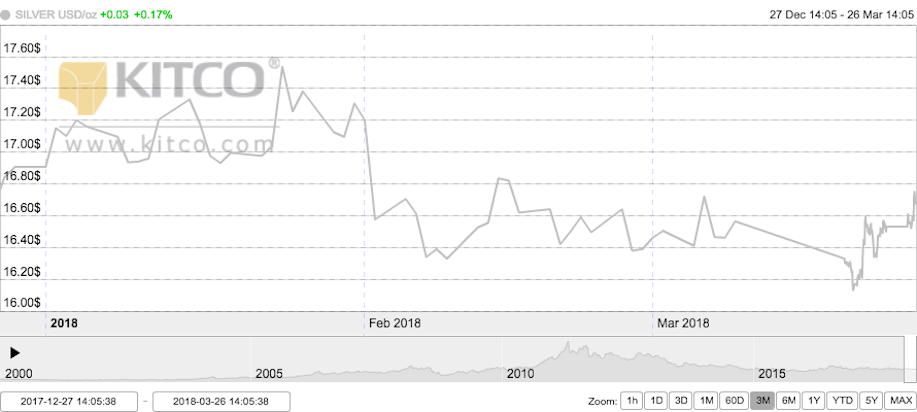

In the first quarter, the silver price rose 0.21 percent. As the chart below from Kitco shows, silver experienced several ups and downs during the period, but reached its highest point towards the end of January.

Chart via Kitco.

In fact, the precious metal found its highest point on January 24, reaching US$17.54. Silver prices increased 0.2 percent on that day, with the support of the US dollar hitting a three-year low after comments that US Treasury secretary Steven Mnuchin welcomed a weaker currency had surfaced.

Meanwhile, silver fell to its lowest point of the quarter on March 20, trading at US$16.14. The gray metal hit this low when the US dollar strengthened ahead of the Federal Reserve meeting regarding a potential interest hike. That’s because higher rates tend to curb the appeal of holding non-yielding assets such as silver.

Silver price update: Factors to watch

As the second quarter of the year begins, investors interested in the silver market should be aware of a number of factors that could impact the precious metal’s price.

Much like gold, most analysts agree that political uncertainty, the state of the US dollar and increased interest rates will continue to be key drivers for the silver price in 2018.

In terms of political uncertainty, analysts at FocusEconomics stated, “[t]he recent upturn in prices came as President Trump decided to impose hefty tariffs on imported steel and aluminum, shaking up markets and intensifying fears of a full-blown trade war. This fueled more safe-haven demand for silver.”

Brien Lundin, editor at Gold Newsletter, also addressed the tariffs, stating, “[I] think they’re terrible. They’re a terrible idea. I think it creates uncertainty which creates volatility in the market.” Volatility in the market often equals investors searching for safe-havens, which are typically precious metals.

While gold is typically an investors first choice in a shaky market, Dr. Kal Kotecha, editor and founder of the Junior Gold Report, said “[s]ilver [is] taking on a lot of base metal characteristics as well and being a cheap man’s gold, I believe it’s [going to] propel itself quite a bit higher. So when gold starts moving on a percentage basis, silver will accelerate that and it is only so long you can submerge something.”

Other political concerns stem from US President Trump’s chaotic administration. On Friday (March 16), departures of two key officials, former Secretary of State Rex Tillerson and top economic advisor Gary Cohn, left investors worried. This political disruption resulted in a weakened greenback, which made bullion cheaper for holders of other currencies.

Increased interest rates also drove silver prices during the first quarter, as the US Federal Reserve and their interest hikes took on a major role towards the end of Q1.

As forecast towards the end of Q3 of last year, three interest hikes were proposed for 2018, the first of which took place on March 21. Like gold, silver faced a decline prior to the Fed implementing the hike, but then experienced gains on the back of an official announcement raising the interest rate from 1.5 percent to 1.75 percent, which put pressure on the US dollar.

According to Bilal Hafeez, strategist at Nomura, the dollar’s movements prior to a hike “are all about expectations” and that is what pushes it upward and commodities like silver, down.

“Indeed, the dollar has followed a pattern of trading relatively well into Fed hikes, but selling off after,” he noted.

According to Jim Wyckoff of Kitco, “[t]he selling pressure in gold and silver occurred because traders reckoned a US rate hike would be bearish for the metals. And when the rate hike actually occurred, the metals moved higher because the sellers were already exhausted and had played out their rate-hike hand.”

With two more hikes forecast for 2018 and a steeper outline for hikes in 2019 and 2020, there will be many opportunities for investors to turn their attention to bullion, forcing its prices upward.

Shifting away from its comparison to gold, demand for silver from industrial applications continues to grow, lifting the price of the metal up.

“Along with a decline in global mine supply, stronger demand for industrial usage of silver from solar panel makers and the auto sector as it moves towards increased electrification, has placed upward pressure on prices,.” said analysts for FocusEconomics.

In a report released on January 18, Michael DiRienzo, executive director of the Silver Institute, said “[s]trong industrial demand, jewelry demand and renewed investor interest will continue to support the market as mine production could decline for the second consecutive year by 2 percent in 2018.”

Connect with our Featured Silver Stocks to receive the latest news and investor presentations.

Silver price update: What’s ahead?

Many industry insiders acknowledge the struggle that silver has experienced in Q1, but still predict a bullish year for the gray metal.

According to panelists at FocusEconomics, “[p]rices are expected to rise this year as supply remains constrained and demand from industrial applications continues to grow. Expectations of higher jewelry demand and higher volatility in financial markets are also seen driving up prices.”

Similarly, Fred Davidson, president and CEO of IMPACT Silver (TSXV:IPT) believes that the price of silver will continue to trend upwards. While he does not provide an exact dollar estimate, he does note that there is a problem with current silver pricing.

“Silver is much stronger than it was. But certainly, there’s a bit of weakness in the pricing of silver,” he said.

David Morgan of the Morgan Report is a true believer in silver and its capability to not only increase in price, but outperform gold as well.

“I think this year silver will outperform gold. I could see a 30 percent increase in the price of silver from the bottom, and maybe something similar in gold from last year – 10 to 20 percent. Those are modest numbers relative to what gold can do. But if you compound your money at 20 percent, you could make a fortune over a few years, really,” Morgan said.

He continued,“[t]he appeal about silver is that it’s not top-down controlled like gold.”

Bart Melek at Canadian brokerage TD Securities also forecasts that silver will outperform gold in 2018.

“Considering silver’s underperformance, its traditionally higher volatility and historic relative strength during periods when investors are building gold exposure, the white metal is on track to outperform,” Melek stated.

Melek’s predicts that the average gold prices will land at US$1,313.00 per ounce, while silver will trade at US$18.88 per ounce in 2018. That would put the gold/silver ratio just below 70.

Meanwhile, FocusEconomics panelists estimate that the average silver price for Q2 2018 will be US$17.10. The most bullish forecast for the quarter comes from ANZ and BMO Capital Markets, both of which are calling for a price of US$18.20; meanwhile, Natixis is the most bearish with a forecast of US$16.00.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.

The post Silver Price Update: Q1 2018 in Review appeared first on Investing News Network.

alt=”silver free industry report”>

alt=”silver free industry report”>

Leave A Comment

You must be logged in to post a comment.