– Gold versus Bitcoin: The pro-gold argument takes shape

– Why cryptocurrencies will not replace gold as a store of value

– Similarities between crypto and gold but that does not make them substitutes

– Gold remains a highly liquid market, cryptocurrencies continue to be fragmented and difficult to spend

– Bitcoin does not make it an effective hedge against stocks

This weekend saw bitcoin shoot up over $8,000 and Bloomberg covered how some preppers were turning to bitcoin over gold. Does this mean it’s all over for gold? Is it set to be supplanted as a safe haven by crypto currencies?

Hardly. People read such information and continue to believe that gold and cryptocurrencies are substitute assets. They are not. So why are they so often pitched against one another?

Bitcoin and its contemporaries clearly have a role to play, the volume of demand demonstrates this and the technology is powerful. But, that role is not as a replacement for gold as a store of value.

Risk Hedge sums it up saying:

“Despite what the crypto-evangelists will tell you, digital tokens will never and can never replace gold as your financial hedge.”

Risk Hedge provided a great summary of the major flaws and differences in the gold versus crypto debate and the six reasons are listed below.

#1: Cryptocurrencies Are More Similar to a Fiat Money System Than You Think.

The definition of “fiat money” is a currency that is legal tender but not backed by a physical commodity.

Since the United States abandoned the gold standard in the 1970s, this has been the case with all major currencies, including the US dollar.

Ever since then, US money supply has kept increasing, and so has the national debt. In contrast, the dollar’s purchasing power has been on the decline.

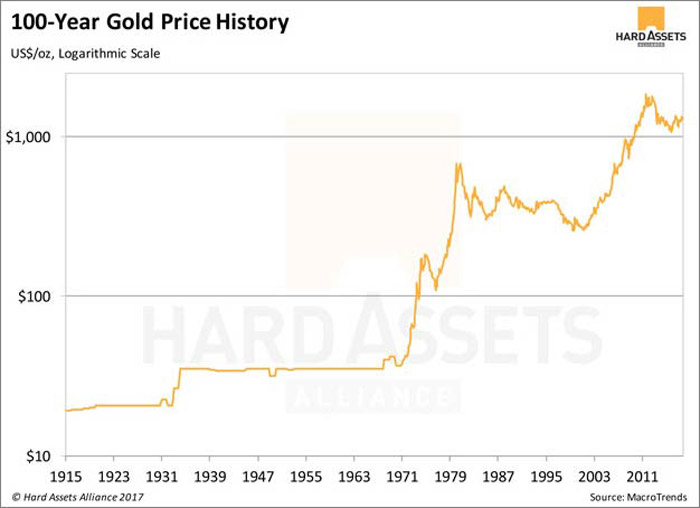

Take a look at this historical gold price chart.

The huge spike in gold prices started right around the time when the Bretton Woods agreement collapsed in 1971 and US paper dollars couldn’t be converted to gold anymore. A clear sign of the decline in the dollar’s purchasing power since the move into a pure fiat money system.

It’s clear that cryptocurrencies partially fit the definition of fiat money. They may not be legal tender yet, but they’re also not backed by any sort of physical commodity. And while total supply is artificially constrained, that constraint is just… well, artificial.

You can’t compare that to the physical constraint on gold’s supply.

Some countries are also exploring the idea of introducing government-backed cryptocurrencies, which would take them one step closer toward fiat-currency status.

As Russia, India, and Estonia are considering their own digital money, Dubai has already taken it one step further. In September, the kingdom announced that it has signed a deal to launch its own blockchain-based currency known as emCash.

So ask yourself, how can you effectively hedge against a fiat money system with another type of fiat money?

#2: Gold Has Always Had and Will Always Have an Accessible Liquid Market.

An asset is only valuable if other people are willing to trade it in return for goods, services, or other assets.

Gold is one of the most liquid assets in existence. You can convert it into cash on the spot, and its value is not bound by national borders. Gold is gold-anywhere you travel in the world, you can exchange gold for whatever the local currency is.

The same cannot be said about cryptocurrencies. While they’re being accepted in more and more places, broad, mainstream acceptance is still a long way off.

What makes gold so liquid is the immense size of its market. The larger the market for an asset, the more liquid it is. According to the World Gold Council, the total value of all gold ever mined is about $7.8 trillion.

By comparison, the total size of the cryptocurrency market stands at about $161 billion as of this writing-and that market cap is split among 1,170 different cryptocurrencies.

That’s a long shot from becoming as liquid and widely accepted as gold.

#3: The Majority of Cryptocurrencies Will Be Wiped Out.

Many Wall Street veterans compare the current rise of cryptocurrencies to the Internet in the early 1990s.

Most stocks that had risen in the first wave of the Internet craze were wiped out after the burst of the dot-com bubble in 2000. The crash, in turn, gave rise to more sustainable Internet companies like Google and Amazon, which thrive to this day.

The same will probably happen with cryptocurrencies. Most of them will get wiped out in the first serious correction. Only a few will become the standard, and nobody knows which ones at this point.

And if major countries like the US jump in and create their own digital currency, they will likely make competing “private” currencies illegal. This is no different from how privately issued banknotes are illegal (although they were legal during the Free Banking Era of 1837–1863).

So while it’s likely that cryptocurrencies will still be around years from now, the question is, which ones? There is no need for such guesswork when it comes to gold.

#4: Lack of Security Undermines Cryptocurrencies’ Effectiveness.

Security is a major drawback facing the cryptocurrency community. It seems that every other month, there is some news of a major hack involving a Bitcoin exchange.

In the past few months, the relatively new cryptocurrency Ether has been a target for hackers. The combined total amount stolen has almost reached $82 million.

Bitcoin, of course, has been the largest target. Based on current prices, just one robbery that took place in 2011 resulted in the hackers taking hold of over $3.7 billion worth of bitcoin-a staggering figure. With security issues surrounding cryptocurrencies still not fully rectified, their capability as an effective hedge is compromised.

When was the last time you heard of a gold depository being robbed? Not to mention the fact that most depositories have full insurance coverage.

#5: Hype and Speculation Continue to Drive Cryptocurrencies’ Value.

Since the beginning of the year, the value of Bitcoin has more than quadrupled-a tremendous spike in value that has sent investors rushing to invest in cryptocurrencies. But could this be nothing more than a market bubble?

One of the world’s most successful hedge fund managers, Ray Dalio of Bridgewater Associates, certainly seems to think so.

In September 2017, he told CNBC, “It’s not an effective store hold of wealth because it has volatility to it, unlike gold. Bitcoin is a highly speculative market. Bitcoin is a bubble.”

The spike in Bitcoin prices seems to only lend credence to this view. With such an extreme degree of volatility, cryptocurrencies’ value as a hedge is questionable. Most people buy them for the sole reason of selling them later at higher prices.

This is pure speculation, not hedging.

#6: Cryptocurrencies Do Not Have Gold’s History as a Store of Value.

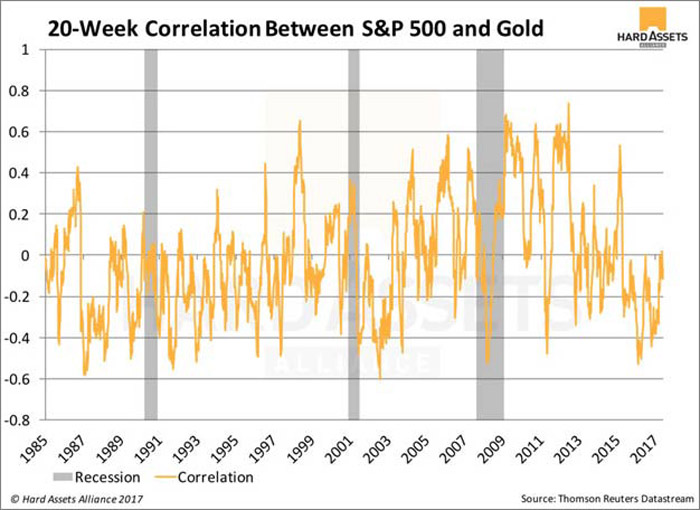

Cryptocurrencies have been around for less than a decade, whereas gold has been used as a store of value for thousands of years. Because of this long history, we know for a fact that stocks and bonds have low or negative correlations with gold, particularly during periods of economic recession. This makes gold a powerful hedge.

What little data we have on cryptocurrencies does not show the same. Consider this year alone: while the US stock market continues to run record highs, the same goes for Bitcoin.

It’s true that gold has also gone up, but the correlation has been very low and, during times of recessions, tends to swing to the negative side, as you can see in the graph below.

Since 2010, there have been 15 times where the S&P 500 has seen drops of 5% or more. Out of those 15 stock market downturns, Bitcoin has been down for 10 of them.

How is that a good hedge?

Read the original article here

Related Content

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

Bitcoin and Gold – Outlook and Safe Haven?

News and Commentary

Gold falls on pressure from stronger dollar, rate hikes in focus (Reuters.com)

Asian Stocks Advance; Dollar, Treasuries Steady (Bloomberg.com)

Gold, Euro Slump As Merkel Admits “New Elections Are The Better Way” (ZeroHedge.com)

Yellen Says She’ll Leave Fed Once Powell Sworn in as Chair (Bloomberg.com)

No EU deposit insurance if bad loans not cut: ECB’s Draghi (Reuters.com)

Gold Drops To Key Technical Support After $2 Billion Purge (ZeroHedge.com)

Gold is rising despite threat of higher interest rates – Rickards (DailyReckoning.com)

Thorne, Magic Money, and Cyberbucks: Three pre-Bitcoin monetary experiments (JPKoning.Blogspot.ie)

The Fed Plans For The Coming Recession – Next-Generation Crazy (DollarCollapse.com)

ECB wants to end deposit protection & offer savers ‘appropriate amount’ of their own money (RT.com)

Gold Prices (LBMA AM)

21 Nov: USD 1,280.00, GBP 967.04 & EUR 1,090.69 per ounce

20 Nov: USD 1,292.35, GBP 974.82 & EUR 1,096.43 per ounce

17 Nov: USD 1,283.85, GBP 969.31 & EUR 1,088.19 per ounce

16 Nov: USD 1,277.70, GBP 969.01 & EUR 1,085.53 per ounce

15 Nov: USD 1,285.70, GBP 976.62 & EUR 1,086.29 per ounce

14 Nov: USD 1,273.70, GBP 972.47 & EUR 1,086.59 per ounce

13 Nov: USD 1,278.40, GBP 977.59 & EUR 1,097.89 per ounce

Silver Prices (LBMA)

21 Nov: USD 17.00, GBP 12.85 & EUR 14.50 per ounce

20 Nov: USD 17.15, GBP 12.94 & EUR 14.56 per ounce

17 Nov: USD 17.09, GBP 12.95 & EUR 14.49 per ounce

16 Nov: USD 17.04, GBP 12.92 & EUR 14.48 per ounce

15 Nov: USD 17.12, GBP 13.00 & EUR 14.45 per ounce

14 Nov: USD 16.94, GBP 12.92 & EUR 14.45 per ounce

13 Nov: USD 16.93, GBP 12.93 & EUR 14.53 per ounce

Recent Market Updates

– Money and Markets Infographic Shows Silver Most Undervalued Asset

– Is New Fed Chief A “Swamp Critter Extraordinaire”?

– Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe

– UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

– Protect Your Savings With Gold: ECB Propose End To Deposit Protection

– Internet Shutdowns Show Physical Gold Is Ultimate Protection

– Gold Coins and Bars Saw Demand Rise 17% to 222T in Q3

– Prepare For Interest Rate Rises And Global Debt Bubble Collapse

– Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

– World’s Largest Gold Producer China Sees Production Fall 10%

– German Investors Now World’s Largest Gold Buyers

– Gold Price Reacts as Central Banks Start Major Change

– Why Switzerland Could Save the World and Protect Your Gold

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

The post Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.