American CuMo Mining Corporation (TSXV:MLY) (OTC Pink: MLYCF) (“CuMoCo” or the “Company”) is pleased to provide shareholders with an update on its projects and corporate developments.

All eligible shareholders have been issued or mailed their Rights, and ineligible shareholders have been sent a letter explaining the process for making their Rights eligible. The Rights are now trading under the symbol MLY.RT. As announced in the Company’s November 2, 2017 news release, eligible shareholders receive one (1) Right for each common share held. Two (2) Rights entitle the holder to subscribe for one (1) common share of the Company upon payment of the subscription price of C$0.07 per share (the “Subscription Price”). For example, a holder of 1,000 common shares will be entitled to subscribe for 500 common shares for an aggregate subscription price of C$35.00.

Shareholders who fully exercise their Rights will also be entitled to subscribe for additional shares in the Rights Offering, if available, as a result of unexercised Rights prior to the Expiry Time, subject to certain limitations set out in CuMoCo’s Rights Offering Circular.

The Rights will continue to trade on the TSX Venture Exchange under the symbol MLY.RT until 9:00 a.m. PST on December 9, 2017. The Rights will expire at 2:00 p.m. PST on December 9, 2017 (the “Expiry Time”), after which time unexercised Rights will be void and of no value. No fractional shares will be issued.

The process for exercising Rights varies according to how shareholders hold their shares:

If shares are held at a brokerage firm, shareholders should instruct their broker to exercise the Rights, and the broker sends the funding to Computershare. Upon closing, Computershare will issue a share certificate directly to the Broker.

If the shares are registered in a shareholder’s name, the shareholder will receive a Rights certificate which needs to be signed and sent along with a certified check, bank draft, or money order for the shares to Computershare and upon closing, Computershare will issue the shares directly to the shareholder.

The Company intends to use the funds to repay the debentures owed to IEMR(HK), to fund a Pre-Feasibility Study for the CuMo Project that will include the Ore-Sorting results and other optimizations to improve on the results in the November 15, 2015 Preliminary Economic Analysis (PEA), and to continue analyzing the results of the Calida Gold 2017 work program.

At the Company’s Calida Gold project, the first set of assays have been completed. These are for the surface grab samples taken from various exposures on the project site. The Company has created an interactive photo web page that shows the location of various points of interest, including photos taken at the locations, and examples of the mineralization exposed (http://cumoco.com/projects/cumo_project/interactive-photos/). Also, photographs of Hole 18 have been added to show an example of an intersected mineralized zone.

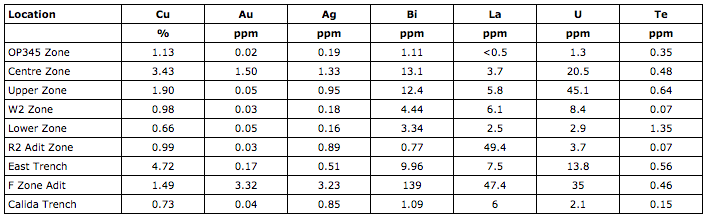

The assay results, shown in the table below, confirm the presence of copper and gold in the Calida system, with gold values ranging from 0.02 to 3.32 gms Au/T and copper values ranging from 0.66% to 4.72% Cu.

Readers are cautioned these are grab samples from the zones exposed and may not represent the entire width of the mineralized zone and are an indication of the target mineralized zones.

In addition to the copper and gold, several other elements were noted. The higher gold samples also had elevated Bismuth (13.1 and 139 ppm), anomalous Tellurium (0.35 to 1.35 ppm), Lanthanum (47.4 to 49.4 ppm), and Uranium (13.8 to 45.1 ppm). These additional elements suggest that the mineralization at Calida may be similar in age to the Tertiary Lemhi Pass rare-earth bearing deposits, located approximately 20 kilometres to the east of Calida. Work is still ongoing completing the core logging from the 2017 drilling program at Calida.

On November 15, 2017, the US Forest Service determined a supplement to the 2015 Environmental Assessment(EA) is the appropriate level of National Environmental Protection Act (NEPA) analysis needed to complete the current round of permitting for the CuMo Project. The determination is based on the culmination of a USFS Interdisciplinary Team’s review which recorded all findings in a recently released Supplemental Information Report (SIR). Responding to the September 2015 USFS decision related to Sacajawea’s bitterroot (LESA plant) and the subsequent 2016 Pioneer Wildfire that burned 55 percent of the Project area, Idaho CuMo Mining Corporation entered a Memorandum of Understanding with USFS to hire third-party NEPA Contractor, Stantec, to draft the SIR and complete a Revised Supplemental Environmental Assessment (SEA).

The SIR addresses new information and changed circumstances regarding the Sacajawea’s bitterroot and all the natural resources that may have been impacted by the wildfire including soils and vegetation. The analysis indicates that the Pioneer fire had little or no effect on the LESA plant and that the plant’s population is far more numerous than previously established. Several large LESA populations have been found well outside the CuMo Project area. Additionally, it has been established that ground disturbing activities appear to have no negative effect on LESA numbers, rather, plant populations appear to benefit when the ground is disturbed.

During a recent tour of the CuMo property by management and potentially interested parties, a historic ore pile from underground workings was found 4500 feet (1371 meters) east of the easternmost drill hole at CuMo on the recently optioned Coon Dog claim, showing several distinct types of mineralization. Mineralization consisted of quartz vein, quartz breccia and quartz stockwork, with visible pyrite and chalcopyrite and local patches of massive sulphide. A grab sample has been sent for assaying to determine which of the two porphyry systems (the younger, Molybdenum-Copper-Silver or the older Copper-Gold system) that are present at CuMo the mineralization belongs to. The Company is intending to drill the eastern extension of CuMo during the 2018 field program from the private land recently optioned.

Shaun Dykes, President and CEO of CuMoCo commented: “The discovery of mineralization this far out from the CuMo deposit continues to confirm the enormous size and extent of the mineralization present within the CuMo Property.”

Finally, the Company continues to work with several parties regarding its financing activities and projects.

Mr Shaun M. Dykes, M.Sc. (Eng), P.Geo., President and CEO of the Company, is the designated qualified person for the CuMo Project and the Calida Gold project and has prepared the technical information contained in this news release.

About CuMoCo

CuMoCo is focused on advancing its CuMo Project towards feasibility. CuMoCo is also advancing its newly-acquired Calida Gold project. For more information, please visit cumoco.com, idahocumo.com and cumoproject.com.

For further information, please contact:

American CuMo Mining Corporation

Shaun Dykes, President and Chief Executive Officer

Tel: (604) 689-7902

Email: info@cumoco.com

Cautionary statement regarding forward-looking information

Certain disclosures in this release constitute “forward-looking information” within the meaning of Canadian securities legislation. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by words such as the following: expects, plans, anticipates, believes, intends, estimates, projects, assumes, potential and similar expressions. Forward-looking statements also include reference to events or conditions that will, would, may, could or should occur, including, without limitation, details of the Rights Offering, the intended use of proceeds of the Rights Offering, and expected outcomes. In making the forward-looking statements in this news release, the Company has applied certain factors and assumptions that the Company believes are reasonable, including that the Company’s permitting will proceed as expected; that the Rights Offering will be completed and will raise the expected proceeds; that the results of exploration and development activities are consistent with management’s expectations and that the assumptions underlying mineral resource estimates are valid. However, the forward-looking statements in this news release are subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking statements, including without limitation: that the Rights Offering will otherwise not be completed or will raise less than the expected proceeds; uncertainties as to the costs to completion of the rights offering; the results of exploration and development activities will not be consistent with management’s expectations, the risk of unexpected variations in mineral resources, grade or recovery rates, delays in obtaining or inability to obtain required government or other regulatory approvals or financing, failure of plant, equipment or processes to operate as anticipated, the risk of accidents, labor disputes, inclement or hazardous weather conditions, unusual or unexpected geological conditions, ground control problems, earthquakes, flooding and all of the other risks generally associated with the development of mining facilities and the operation of a producing mine. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this new release.

The post American CuMo Mining Updates Shareholders appeared first on Investing News Network.

Leave A Comment

You must be logged in to post a comment.