Weekly Gold Update by Daniel March for GoldCore (May 6, 2018)

Editor: Mark O’Byrne

Gold in US dollar terms ended the week down 0.75%. Gold’s decline was likely primarily due to a stronger US Dollar Index (USDX) which was up 1.1%.

Gold rose after the worse than expected non farm payrolls on Friday before reversing the gains and then bouncign to close the day marginally higher. US job growth increased less than expected last month with the US economy adding just 164,000 jobs in April. This was less than the 193,000 jobs expected.

The USDX started the week strong, and once it pushed past its 200 dma in early trading Tuesday, both gold and silver were unable to hold up with selling pressure in the futures market.

A stronger US dollar came despite a backdrop of weakening economic data, US Pending Home Sales, ISM PMI, and the Non Farm Payrolls on Friday all came in below expectations.

The US economic outlook is clearly deteriorating but it appears to be still outperforming it’s global peers including the struggling UK and fragile EU. This served as a reflection point, as traders recognised the relative US strength and bid up the dollar, squeezing the long standing shorts out of the market. However, while a strong dollar is traditionally not a friendly environment for the precious metals, on-going uncertainty in the stock and bond markets have served to limit the downside in gold this week.

For holders of gold in EUR and GBP and other fiat currencies, many say gains with EUR and GBP gold buyers seeing their holdings gain in purchasing power by 0.7% and 0.9%, respectively.

On monetary policy, the Federal Reserve left rates on hold Wednesday, and acknowledged building inflation pressures, signalling their willingness to allow inflation to move around their 2% target ‘symmetrically’. In addition, they removed the wording “The economic outlook has strengthened in recent months”, perhaps in response to the weaker than expected economic data.

So with inflationary pressures building, and economic growth slowing, one has to ask how long the Fed can stick with their ‘dot-plot’ for future rates hike particularly when the Central Banks of Europe, UK, China and Japan are looking to reverse the tightening course and in some cases outright ease.

Perhaps this admission by the FED on a higher inflation, lower growth environment outlook is acknowledging the fact they will need to realign to global policy sooner rather than later.

Geopolitical risks have eased since last week’s symbolic meeting between the North and South Korean leaders. The stage is now set for the US to meet with the North Koreans later this month in the Demilitarized Zone (DMZ). However, tensions still persist in the Middle East with almost daily events occurring in Syria and Iran with little or no reaction from the markets so far.

It’s almost as if the world has become slight desensitized by the uncertainty and risks in the region. However, the Middle East remains a power keg and should there be a significant escalation in the region, gold will quickly erase any short term weakness and catch a safe haven bid in a heartbeat.

There were bullish developments in the latest Commitment of Traders (COT) report, released for the week ending Tuesday May 1st. Large speculators (historically the dumb money) reduced their net long position in gold by 29,867 contracts, while the commercials (historically smart money) reduced their net short position by an almost identical amount of 29,928 contracts.

In silver, the large speculators sold into the recent price weakness, and are once again net short 7,196 contracts. While the commercials did the opposite, buying back their shorts, leaving them now net short just 11,978 contracts.

Physical gold buying in the worlds 2nd largest gold consumer India looks set to increase in Q2 this year from a combination of positive monsoon rains and government efforts to boost rural incomes. Two-thirds of Indian demand comes from rural areas, and in an interview this week with Reuters, the WGC India commented:

“The government’s measures to boost rural incomes by increasing the subsidized prices for food grains and the forecast for a normal monsoon rains in 2018 will bolster demand … The aggregate demand in April to December would be higher than last year’s three quarters.”

All of which provides strength to the Indian gold market for Q2, given the headwinds to demand the last couple of years, from a combination of higher levies on gold imports, and the fallout from removing high denomination banks notes from circulation.

In Turkey physical purchases are up significantly in Q1 this year. As we pointed out Friday, the Financial Times reported this week:

“Turkey’s demand for gold surged by more than a third in the first quarter as consumers flocked to the precious metal as a protection against a tumbling currency and rising inflation”.

In the article from the FT, Charles Robertson, global chief economist at Renaissance Capital, said

“After centuries of default and economic instability, Turks are very savvy when it comes to protecting their savings….Gold has always been a store of value for them…”

It’s not just general public that are taking action, Turkey’s central bank have also been aggressively buying gold as they too see the benefits in hedging against an uncertain outlook for their fiat currency and their US dollar foreign exchange reserves. Not to mention the very real geo-political risks on their border in Syria and the wider Middle East.

Looking at the seasonals the summer months are traditionally a weak period for the metals. Data tracked from the last 30 years shows that gold and silver tend to drift lower during the early summer before regularly finding a bottom in late June early July – an anomaly clearly highlighted in the chart from Dimitri Speck’s website – www.seasonax.com. However, while the summer months are usually a headwind to the metals it historically provides a good buying opportunity going into the second half of the year.

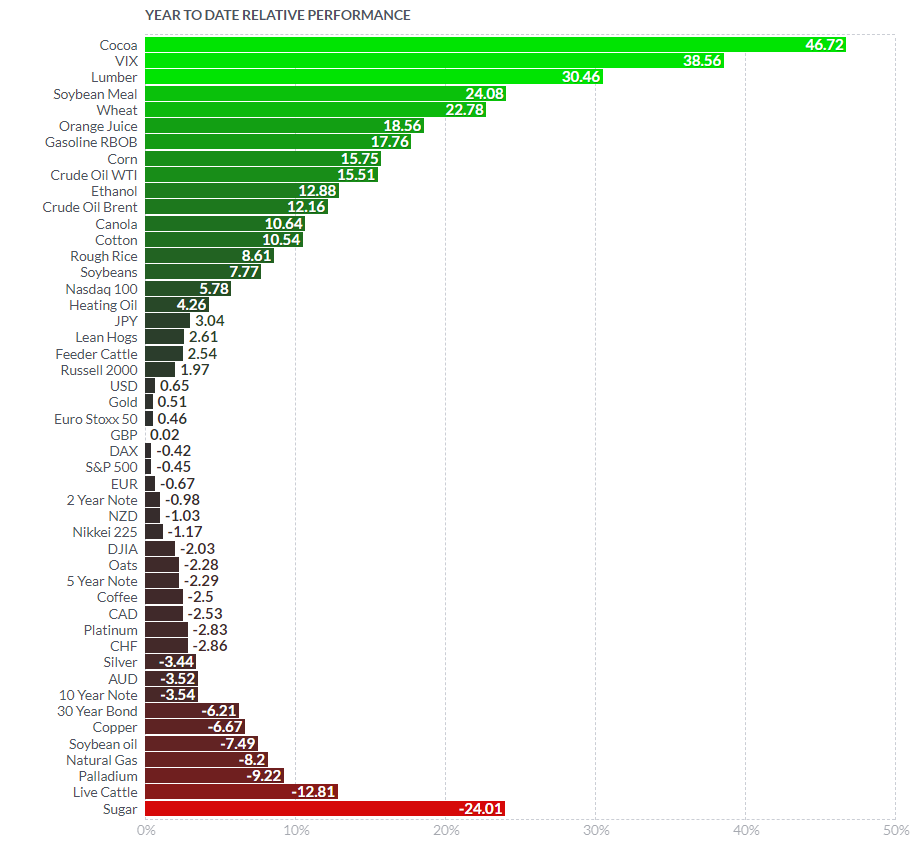

While gold and silver have been largely subdued YTD, up 0.4%, and down 3.76% respectively, we believe that once the growth and inflation prospects become a reality, risk averse retail investors will begin diversifying into precious metals providing the catalyst needed to make the next move higher in gold and silver.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube

News and Commentary

Gold prices steady ahead of U.S. payrolls data (Reuters.com)

Asia Stocks Drop as Trade Talks Held; Dollar Slips (Bloomberg.com)

U.S. Trade Gap Narrows, Claims Remain Low, Productivity Tepid (Bloomberg.com)

U.S. factory orders rise, but business equipment spending slowing (Reuters.com)

ISM non-manufacturing index slows to four-month low in April (MarketWatch.com)

Don’t Be Afraid Of Fed, Gold Price To Touch $1,600 (Forbes.com)

PREPARING FOR A RECESSION (RealVision.com)

Has the Fed really turned hawkish? Or is it just an act? (MoneyWeek.com)

Global RESET Challenge: Ultimate Twist (GoldSeek.com)

Jeffrey Gundlach: Gold to explode (MoneyWeek.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

03 May: USD 1,313.30, GBP 966.19 & EUR 1,094.64 per ounce

02 May: USD 1,310.75, GBP 960.52 & EUR 1,091.99 per ounce

01 May: USD 1,309.20, GBP 956.37 & EUR 1,087.68 per ounce

30 Apr: USD 1,316.25, GBP 958.62 & EUR 1,087.62 per ounce

27 Apr: USD 1,317.70, GBP 954.41 & EUR 1,090.79 per ounce

26 Apr: USD 1,321.90, GBP 949.52 & EUR 1,085.94 per ounce

25 Apr: USD 1,325.70, GBP 949.47 & EUR 1,085.48 per ounce

Silver Prices (LBMA)

03 May: USD 16.47, GBP 12.12 & EUR 13.74 per ounce

02 May: USD 16.35, GBP 11.98 & EUR 13.62 per ounce

01 May: USD 16.25, GBP 11.87 & EUR 13.51 per ounce

30 Apr: USD 16.38, GBP 11.93 & EUR 13.54 per ounce

27 Apr: USD 16.53, GBP 12.01 & EUR 13.68 per ounce

26 Apr: USD 16.58, GBP 11.87 & EUR 13.61 per ounce

25 Apr: USD 16.57, GBP 11.87 & EUR 13.57 per ounce

Recent Market Updates

– Smart Money Diversifying Into Gold – One Billionaire Invests Half His Net Worth

– “Blood In The Streets” Of U.S. Gold Bullion Market As Sale Of Gold Coins Collapse

– Most Important Chart Of The Century For Investors?

– Gold Mining Shares Are Speculative Making Gold Bullion A Better Investment

– Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

– Cash “Vanishes” From Bank Accounts In Ireland

– Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Gold Reserves

– Family Offices and HNWs Invest In Gold Again

– New All Time Record Highs For Gold In 2019

– Palladium Bullion Surges 17% In 9 Days On Russian Supply Concerns

– Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– London House Prices See Fastest Quarterly Fall Since 2009 Crisis

The post Weekly Gold Update – Gold In Dollars Lower Despite Poor US Jobs and Other Data appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.