– Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish

– JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart)

– Silver Speculators Go Short – Which Is Extremely Bullish

– Stunning Silver COT Report: One For the Ages (see chart)

The silver futures Commitment of Traders (COT) report released last Friday was extremely positive and has most silver analysts calling for higher silver prices in the near term.

ZeroHedge.com

The COT data signaled we are close to bottoming and suggest that both gold and silver should make gains in the coming weeks and months. The data showed that the hedge funds and “Managed Money traders,” the “dumb money” speculators now have record short positions in silver.

At the same time, the large commercials and including large bullion banks such as JP Morgan, the “smart money” and the “inside money” have reduced their shorts dramatically and are now long.

The COT report shows ‘Managed money’ silver specs have their largest short position in at least 28 years and maybe ever. From a contrarian perspective this is very bullish.

Goldchartsrus.com

Another less reported bullish factor is JP Morgan continuing to add to its massive silver bullion holdings. They rose to a new record high last week at 139.12 million troy ounces. Either JP Morgan themselves or their clients or both are acquiring physical silver bullion in a big way and are clearly bullish silver.

Goldchartsrus.com

The notes by Ed Steer and Jon Rubino about this are well worth a read and below are the key snippets:

Ed Steer from EdSteerGoldSilver.com in Stunning Silver COT Report: One For the Ages put it this way

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday was right on the money in gold as far as Ted estimates were concerned, but in silver the decline in the Commercial net short position exceeded even his most bullish expectations. Considering the very modest price decline in silver during the reporting week, I thought his “5,000 to 10,000 contract improvement” estimate to be wildly optimistic. How wrong I was!

In silver, the Commercial net short position dropped by an eye-watering 15,564 contracts, or 77.8 million troy ounces of paper silver. Wow!

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube above

Jon Rubino from Dollar Collapse in Silver Speculators Go Short – Which Is Extremely Bullish put it this way:

Silver is a whole different story, with speculators going aggressively net short, something very seldom seen, and commercials almost in balance, which is also unusual. Looked at in a vacuum, this is hyper-bullish.

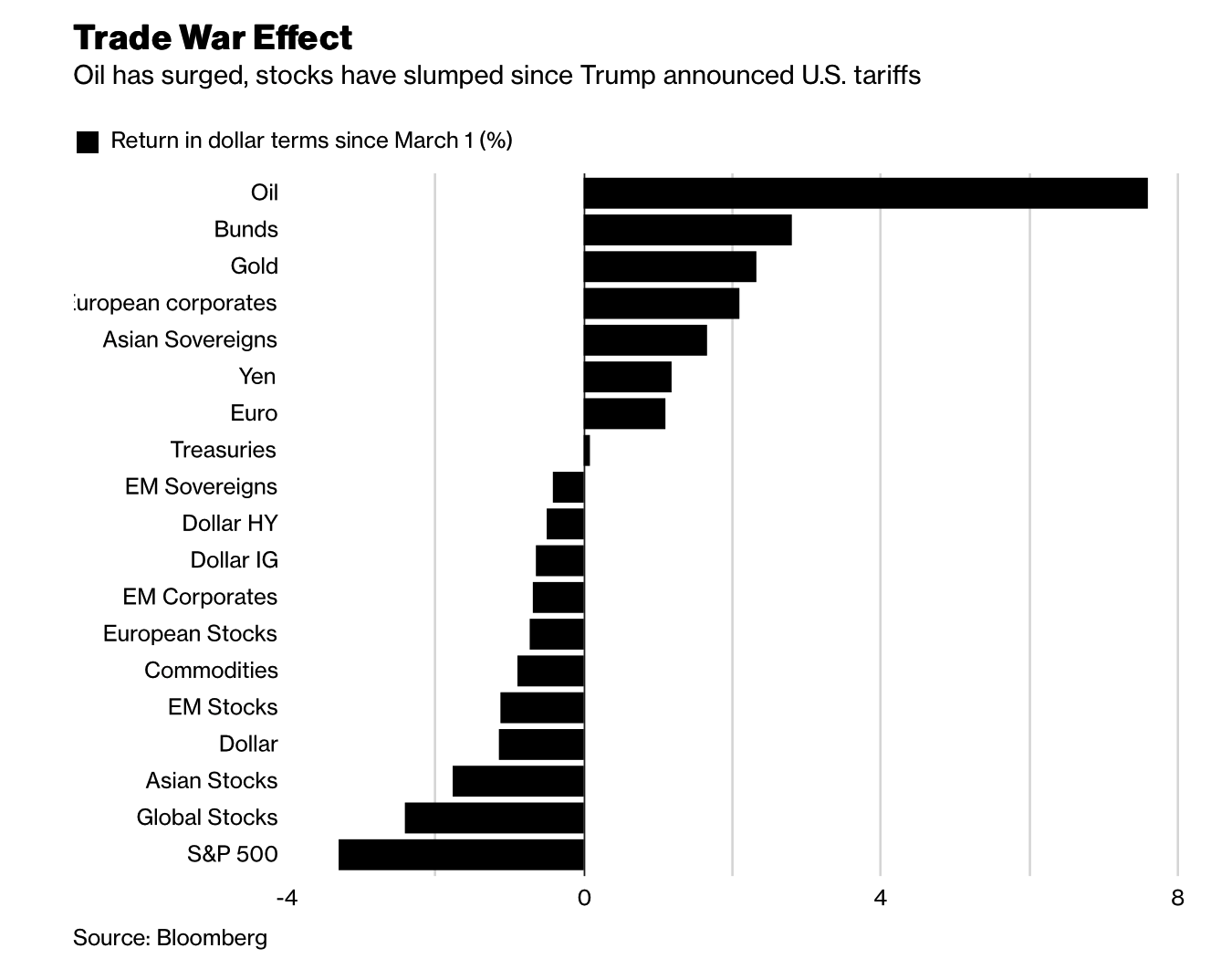

But of course the games futures traders play aren’t all that matters. Between trade wars, massive ongoing government deficits and spiking stock market volatility, the reasons for owning safe haven assets like gold and silver are both multiplying and gaining urgency.

Editors Note: Silver remains very undervalued in the short term and on a long term historical basis. It is also undervalued against gold as seen in the gold silver ratio at over 80:1.

Gold is beginning to receive some interest again from a small minority of retail investors but silver remains the preserve of relatively few contrarian investors. The media and financial press rarely, if ever, covers silver and almost never in a positive manner despite its strong fundamentals.

Yet silver is quite likely in the early stages of a new bull market that will rival or surpass that of the 1970s and thus merits an allocation in investment and pension portfolios.

Related Reading

Money and Markets Infographic Shows Silver Most Undervalued Asset

Buy Silver – “Best Precious Metals Trade”

JP Morgan Cornering Silver Market?

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube above

News and Commentary

Gold marks longest streak of session gains since January (MarketWatch.com)

Gold at more than five-week high as U.S. expels Russian diplomats (Reuters.com)

Dow rises after last week’s rout as trade tensions show signs of cooling (MarketWatch.com)

Stocks Roar Back, Dollar Falls as Trade Angst Ebbs (Bloomberg.com)

World stocks bounce on report of U.S.-China trade talks (Reuters.com)

Source: Bloomberg.com

The World’s Most Controversial Interest Rate Is Haunting Us Again (Bloomberg.com)

As Trade War Heats Up, Biggest Currency Whales Make Their Move (Bloomberg.com)

Mortgage approvals fall 11 percent in February (Reuters.com)

Gold Prices (LBMA AM)

27 Mar: USD 1,350.65, GBP 954.64 & EUR 1,087.41 per ounce

26 Mar: USD 1,348.40, GBP 949.27 & EUR 1,086.95 per ounce

23 Mar: USD 1,342.35, GBP 952.80 & EUR 1,088.65 per ounce

22 Mar: USD 1,328.85, GBP 939.36 & EUR 1,078.10 per ounce

21 Mar: USD 1,316.35, GBP 935.53 & EUR 1,071.64 per ounce

20 Mar: USD 1,312.75, GBP 935.60 & EUR 1,066.22 per ounce

19 Mar: USD 1,311.70, GBP 934.59 & EUR 1,066.41 per ounce

Silver Prices (LBMA)

27 Mar: USD 16.64, GBP 11.79 & EUR 13.41 per ounce

26 Mar: USD 16.61, GBP 11.67 & EUR 13.39 per ounce

23 Mar: USD 16.53, GBP 11.70 & EUR 13.39 per ounce

22 Mar: USD 16.52, GBP 11.64 & EUR 13.41 per ounce

21 Mar: USD 16.25, GBP 11.56 & EUR 13.23 per ounce

20 Mar: USD 16.25, GBP 11.60 & EUR 13.22 per ounce

19 Mar: USD 16.29, GBP 11.59 & EUR 13.24 per ounce

Recent Market Updates

– London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

– Global Trade War Fears See Precious Metals Gain And Stocks Fall

– Gold +1.8%, Silver +2.5% As Fed Increases Rates And Trade War Looms

– Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

– Four Charts: Debt, Defaults and Bankruptcies To See Higher Gold

– Crock Of Gold Hidden In Ireland? Happy Saint Patrick’s Day

– Buy Silver And Sell Gold Now

– Stephen Hawking – Doomsday Prophet’s Top Five Predictions

– Gold Cup At Cheltenham – Gold Is For Winners, Not For the Gamblers

– Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

– Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

– Gold Protects As Cashless Society Threatens Vulnerable

– Women’s Pension Crisis Highlights Dangers To Savers

The post Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.