– Russian central bank buys gold – large 600,000 ounces or 18.7 tons of gold in January

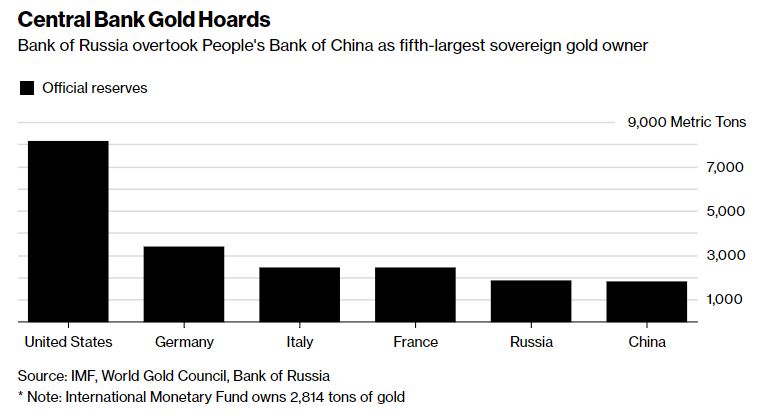

– Russia increased its holdings to 1,857 tons, topping the People’s Bank of China’s ‘reported’ 1,843 tons

– Russia surpasses China as 6th largest holder of gold reserves – after U.S., Germany, IMF, Italy and France

– Turkish central bank added 205 tons “over 13 consecutive months” – Commerzbank

– Meanwhile, Russian ally Venezuela is launching a new gold-backed cryptocurrency next week

Russia has overtaken China as the fifth-biggest sovereign holder of gold, allowing it to diversify its foreign currency holdings amid a deepening rift with the US, Bloomberg News’ Eddie van der Walt reported overnight.

The Bank of Russia increased its holdings in January by almost 20 metric tons to 1,857 tons, topping the People’s Bank of China’s reported 1,843 tons. While Russia has increased its holdings every month since March 2015, China last reported buying gold in October 2016. The U.S. is still the largest owner of gold, with 8,134 tons, much of it stored in Fort Knox.

Russia’s central bank continues to add gold to reserves while the People’s Bank of China remains on hold, pointed out Commerzbank.

Analysts cited news that the Russian central bank bought 600,000 ounces, or 18.7 tons, of gold in January as it continued to diversify its reserves. Analysts cite IMF data showing that Turkey also bought large quantities of gold in January at 560,000 ounces or 17.4 tons.

“Thus the Turkish central bank has topped up its gold reserves by a total of 205 tonnes over 13 consecutive months,” Commerzbank added.

Kazakhstan continues to buy gold in small quantities, as it has been doing steadily for years.

This goes some way to plugging the gap left by the Chinese central bank. The PBOC, meanwhile, has not reported the purchase of gold for 15 months in a row.

Venezuelan President Nicolas Maduro said yesterday that his government was preparing to launch a new gold-backed cryptocurrency token next week as reported by Reuters.

Venezuela is preparing a new cryptocurrency called “petro gold” that will be backed by precious metals, Maduro said yesterday, a day after launching an oil-backed token.

“I don’t want to get ahead of things, but we have prepared a surprise, a gold-backed ‘petro,’ which will have the same parameters as the oil-backed ‘petro.’ This topic will be raised next week,” Maduro said.

Related Content

Russia Gold Rush Sees Record Reserves For Putin Era

Own Gold Bullion To “Support National Security” – Russian Central Bank

News and Commentary

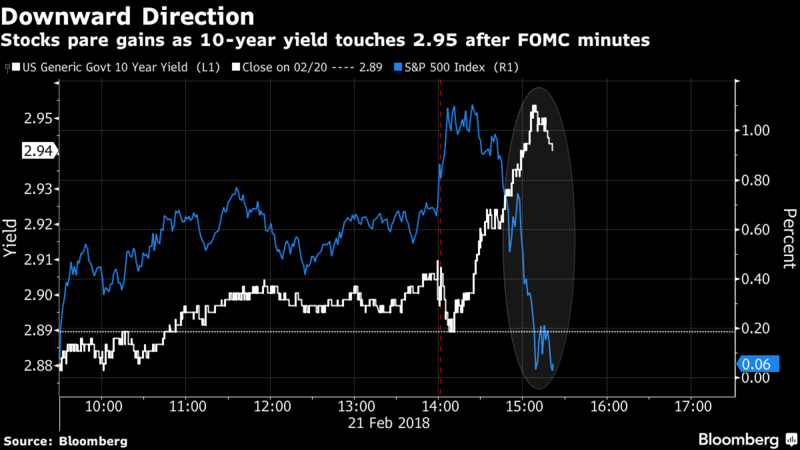

Stocks Turn Lower, Dollar Rises After Fed Minutes (Bloomberg.com)

Venezuela’s Maduro Announces Another Cryptocurrency, Now Gold-Backed (SputnikNews.com)

Gold prices flat, U.S. interest rate outlook weighs (Reuters.com)

FDIC sues 16 banks alleging LIBOR manipulation in Doral Bank collapse (Reuters.com)

U.K. Economic Growth Revised Down as Consumers Hit by Inflation (Bloomberg.com)

Source: Bloomberg

Ireland – Worst Property Crisis in Western Europe Is Still Affecting Business (Bloomberg.com)

This Is Where The Next US Debt Crisis Is Hiding (ZeroHedge.com)

South Africa’s Brand New President Wants To Confiscate Land From White Farmers (ZeroHedge.com)

Meet the Italian government’s Orwellian new automated tax snitch (SovereignMan.com)

City should fear Corbyn much more than Brexit (CityAM.com)

Gold Prices (LBMA AM)

22 Feb: USD 1,323.50, GBP 952.66 & EUR 1,076.40 per ounce

21 Feb: USD 1,328.60, GBP 952.87 & EUR 1,078.16 per ounce

20 Feb: USD 1,337.40, GBP 955.97 & EUR 1,083.83 per ounce

19 Feb: USD 1,347.40, GBP 961.10 & EUR 1,085.47 per ounce

16 Feb: USD 1,358.60, GBP 964.61 & EUR 1,086.47 per ounce

15 Feb: USD 1,353.70, GBP 962.21 & EUR 1,084.45 per ounce

Silver Prices (LBMA)

22 Feb: USD 16.47, GBP 11.86 & EUR 13.40 per ounce

21 Feb: USD 16.44, GBP 11.80 & EUR 13.35 per ounce

20 Feb: USD 16.57, GBP 11.85 & EUR 13.42 per ounce

19 Feb: USD 16.72, GBP 11.92 & EUR 13.46 per ounce

16 Feb: USD 16.84, GBP 11.97 & EUR 13.49 per ounce

15 Feb: USD 16.83, GBP 11.98 & EUR 13.49 per ounce

Recent Market Updates

– Bitcoin or British Pound ‘Pretty Much Failed’ As Currency?

– Bank Bail-In Risk In European Countries Seen In 5 Key Charts

– US-China Trade War Escalates As Further Measures Are Taken

– Gold Up 3.8% In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years

– Is The Gold Price Heading Higher? IG TV Interview GoldCore

– Global Debt Crisis II Cometh

– Sovereign Wealth Funds Investing In Gold For “Long Term Returns” – PwC

– Bitcoin and Crypto Prices Being Manipulated Like Precious Metals?

– “This Is Where They Completely Lost Their Minds” – Hussman

– Brexit Risks Increase – London Property Market and Pound Vulnerable

– Peak Gold: Global Gold Supply Flat In 2017 As China Output Falls By 9%

– Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin

– Gold Rises As Global Stocks Plunge and Bitcoin Crashes 70%

Call for Gold Sovereigns at Ultra Low 4% Premium For Storage in London or Insured Delivery

The post Russian Central Bank Buys Gold – 600,000 Ounces Or 18.7 Tons In January As Venezuela Launches ‘Petro Gold’ appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.