‘Fear and Loathing In the Age of QE … AI’ is a presentation given at Mining Investment London earlier this week.

Stephen Flood, CEO of GoldCore presentation (28 minutes) was well received at the conference which is a strategic mining and investment conference for leaders in the mining and investment sectors, bringing together attendees from 20 countries.

Key topics in the video:

– A bullion dealers view on ‘What will drive the markets in 2018?’

– QE, inflation, Fed rates, debt bomb, China, populism, EU cohesion, Brexit, digital disruption, cashless society, demographics, Trump (war), Artificial intelligence (AI)

– Solve global debt crisis with humongous amount of debt!?

– Inflation – U.S. health insurance has increased 13% per annum since

– How Artificial Intelligence (AI) is the “big one,” likely be massively disruptive

– Trump: ‘No respect, no capacity, no strategy’

– Brexit and EU – ‘Poor outlook’ for Europe and euro doomed?

– “We are getting older and getting fatter” … “less useful & less fair”

– “We live in uncertain times … there is no map”

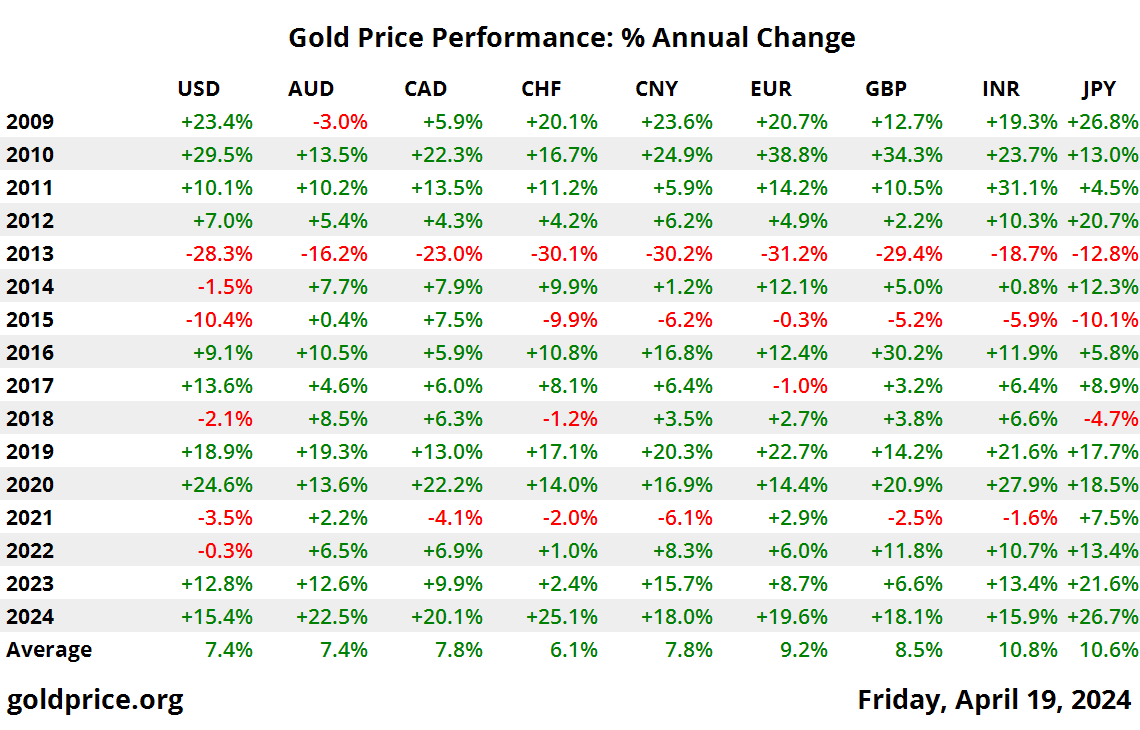

– Gold’s excellent c.10% per annum performance over long term (see table)

– Low cost gold = Low “utility” gold

– Avoid “single point of failure”

‘Fear and Loathing In the Age of QE … AI’ can be watched on Youtube here

Related Videos

GoldNomics – Cash or Gold Bullion?

Why Silver Bullion Is Set To Soar – GoldCore Interview

Gold Bullion Stored In Singapore Is Safest – Marc Faber

Russia Seen More Likely to Sell Dollar Rather Than Gold

Talking Gold with CNN’s Richard Quest

News and Commentary

Gold holds near one-week low as dollar firms (Reuters.com)

Tech Stock Slide Spreads to Asia; Korean Won Drops (Bloomberg.com)

U.S. Stocks Dragged Down by Tech Rout; Bonds Fall (Bloomberg.com)

Goldman Says the Bitcoin Haters Just Don’t Get It (Bloomberg.com)

Fidelity restores online account access after resolving technical issue (CNBC.com)

Source: Bloomberg

Goldman Warns That Market Valuations Are at Their Highest Since 1900 (Bloomberg.com)

Bitcoin Tops $11,000 – Bundesbank Sees No Bubble, Stiglitz Says “Should Be Outlawed” (ZeroHedge.com)

Own Bitcoin – But Invest No More Than You Can Afford To Lose (StansBerryChurcHouse.com)

What to do if you’ve missed out on the bitcoin super-bubble (MoneyWeek.com)

Gold Slammed On Massive Volume To Key Technical Support On GDP Beat (ZeroHedge.com)

Gold Prices (LBMA AM)

30 Nov: USD 1,282.15, GBP 952.64 & EUR 1,084.06 per ounce

29 Nov: USD 1,294.85, GBP 965.70 & EUR 1,092.46 per ounce

28 Nov: USD 1,293.90, GBP 972.75 & EUR 1,088.95 per ounce

27 Nov: USD 1,294.70, GBP 969.73 & EUR 1,084.83 per ounce

24 Nov: USD 1,289.15, GBP 967.89 & EUR 1,086.37 per ounce

23 Nov: USD 1,290.15, GBP 969.93 & EUR 1,089.40 per ounce

22 Nov: USD 1,283.95, GBP 969.25 & EUR 1,092.51 per ounce

Silver Prices (LBMA)

30 Nov: USD 16.57, GBP 12.32 & EUR 14.00 per ounce

29 Nov: USD 16.90, GBP 12.60 & EUR 14.26 per ounce

28 Nov: USD 17.07, GBP 12.84 & EUR 14.36 per ounce

27 Nov: USD 17.10, GBP 12.81 & EUR 14.32 per ounce

24 Nov: USD 17.05, GBP 12.80 & EUR 14.38 per ounce

23 Nov: USD 17.10, GBP 12.84 & EUR 14.43 per ounce

22 Nov: USD 16.97, GBP 12.81 & EUR 14.44 per ounce

Recent Market Updates

– Own Gold Bullion To “Support National Security” – Russian Central Bank

– Bitcoin $10,000 – Huge Volatility of Cryptocurrencies and Risky Fiat Making Gold Attractive

– Financial Advice from Dr Wayne Dyer

– Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

– Brexit Budget – Grim Outlook As UK Economy Downgraded

– Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

– Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape

– Money and Markets Infographic Shows Silver Most Undervalued Asset

– Is New Fed Chief A “Swamp Critter Extraordinaire”?

– Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe

– UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

– Protect Your Savings With Gold: ECB Propose End To Deposit Protection

– Internet Shutdowns Show Physical Gold Is Ultimate Protection

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

The post Low Cost Gold In The Age Of QE, AI, Trump and War appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.