Jamie Dimon Warns Of Potential ‘Market Panic’

– JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’

– In annual letter to shareholders Dimon warns of increased inflation and interest rates

– Concerned QE unwinding could cause chaos as ‘markets will get more volatile’

– Hard to look at the last 20 years in America “and not think that it has been getting increasingly worse.”

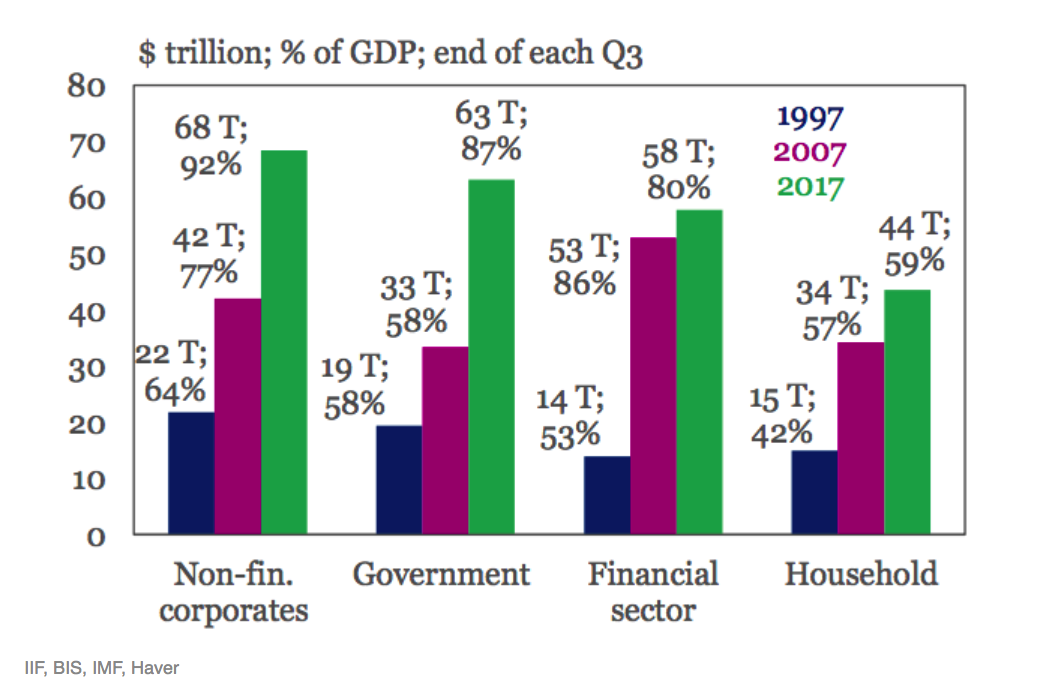

– Positive about US economy over next year, but ignores record levels of world and government debt

– Believes major buyers of US debt (e.g. China) could reduce their purchases of US government debt

– Investors can protect portfolios with gold and silver bullion

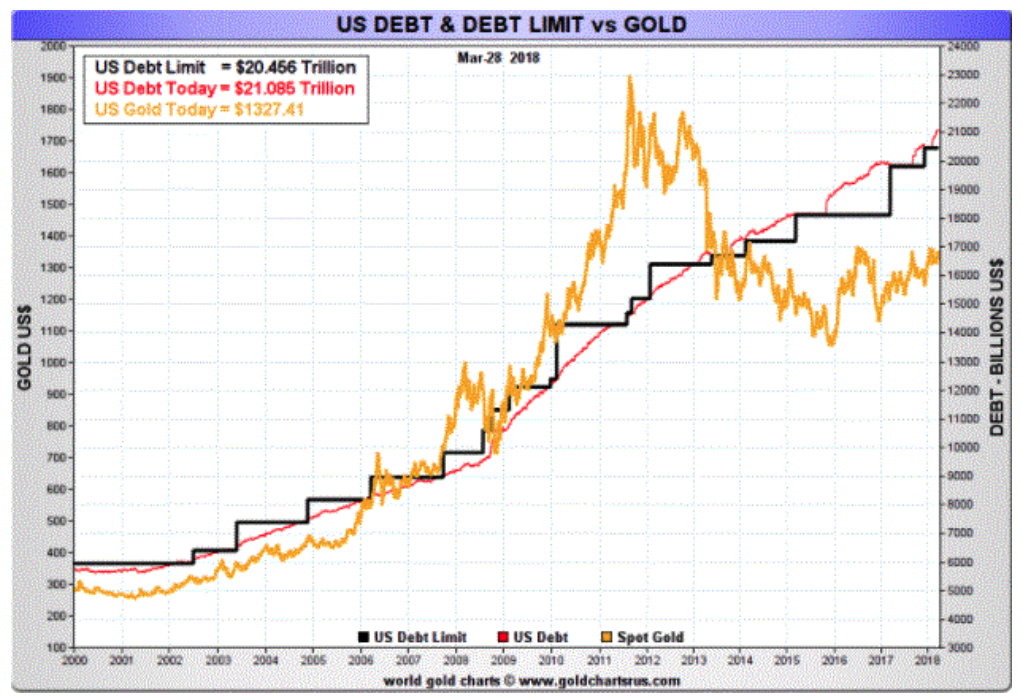

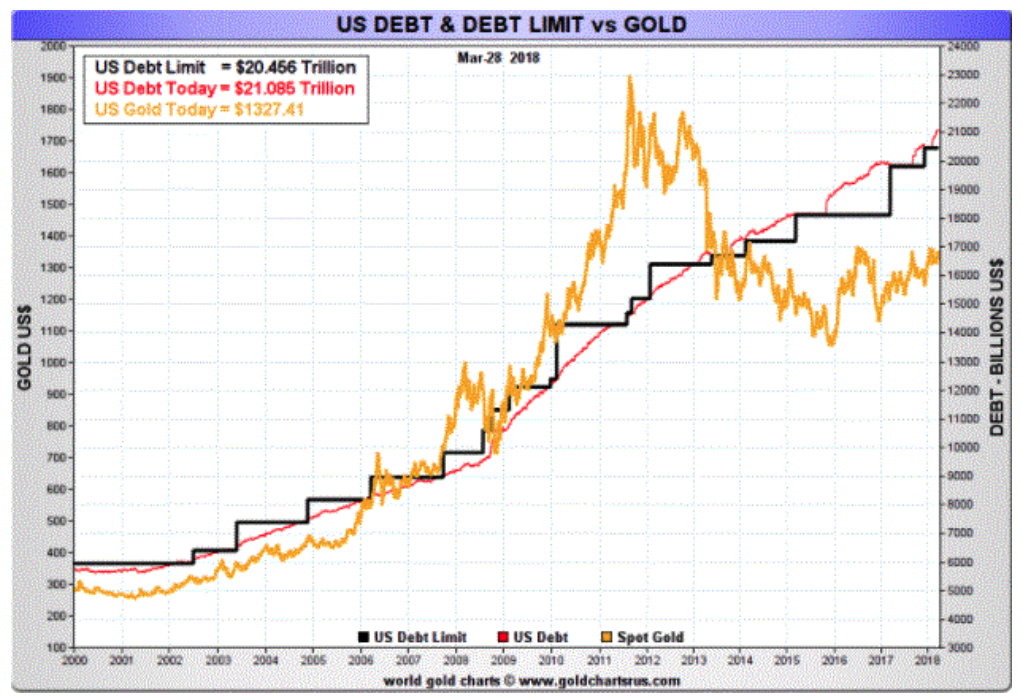

– U.S. debt and dollar crisis coming which will propel gold higher (see chart)

The following has been taken from Simon Black’s SovereignMan.com.

The most powerful banker in the world, JPMorgan Chase CEO Jamie Dimon, just released his annual letter to shareholders.

Behind Warren Buffett’s annual missive, Dimon’s letter is probably the most read and deliberated executive report out there.

For one, Dimon is one of the most connected and respected men in finance.

And given his bank’s massive size (it earned $24.4 billion on $103.6 billion in revenue last year) and reach (it’s a giant in consumer/commercial banking, investment banking and wealth management), Dimon has incredible visibility and intel on what’s going on around the world.

This year Dimon used a large chunk of his 46-page letter to share his thoughts on government and public policy, saying it’s hard to look at the last 20 years in America “and not think that it has been getting increasingly worse.”

And if you’d like to hear how Dimon suggests we fix regulation, immigration, taxation, infrastructure, education and every other problem in America today, it’s all in there.

I’m not really interested in his political views. Dimon runs one of the biggest banks in the world, so I’m much more interested in his insights into the economy and financial markets.

Fortunately, Dimon didn’t waste all of his letter on politics.

He says the US economy seems healthy today and he’s bullish for the “next year or so.”

He sees lower unemployment, higher capital spending, wage growth, low housing supply and “relatively strong” consumer and corporate credit aiding growth.

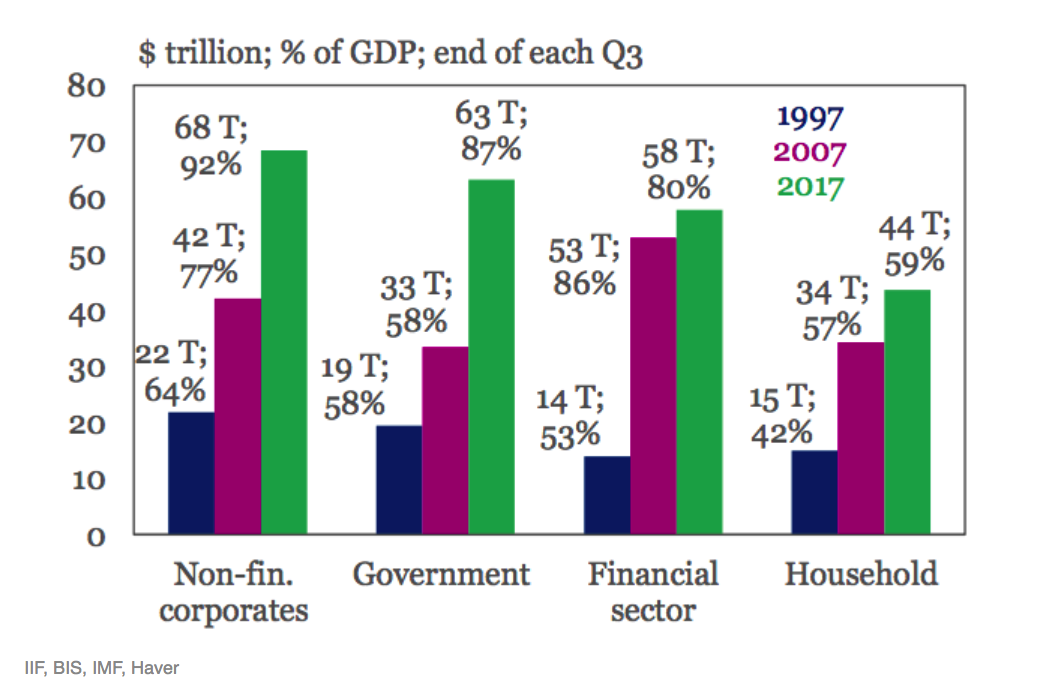

Well, it’s easy to have rose-colored lenses when your profits come from lending money… because there’s more debt in the world today than ever before.

Both corporations and consumers are sitting on a record amount of debt. And as I pointed out earlier this week, the fastest growing bank asset last year was subprime loans… meaning that the quality of debt is getting worse and worse.

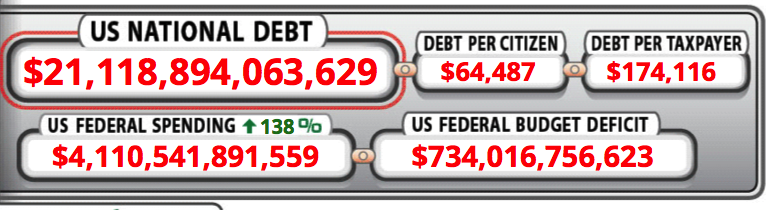

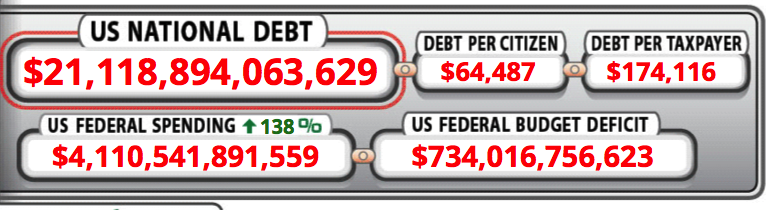

Then there’s the US government, whose debts just passed $21 trillion for the first time in history.

Source: usdebtclock.org

And they’re projecting adding another trillion dollars of debt each year into the foreseeable future.

Later in his letter, Dimon admits that the US is facing some serious economic headwinds today.

For one, he’s concerned the unwinding of quantitative easing (QE) could have unintended consequences.

Remember- QE is just a fancy name for the trillions of dollars that the Federal Reserve conjured out of thin air.

According to Dimon [my emphasis added]:

Since QE has never been done on this scale and we don’t completely know the myriad effects it has had on asset prices, confidence, capital expenditures and other factors, we cannot possibly know all of the effects of its reversal.

We have to deal with the possibility that at one point, the Federal Reserve and other central banks may have to take more drastic action than they currently anticipate – reacting to the markets, not guiding the markets.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

To that point, the Dow dropped over 700 points intraday Monday. Then it dropped over 500 points on Wednesday, before ending the day slightly higher.

But this extreme volatility does suggest the bull market is nearing its end… if it hasn’t ended already.

And if we see the bottom fall out in stocks, you can be sure the Fed will change course, as Dimon suggests.

While nobody has a crystal ball when it comes to the markets, Dimon seems pretty sure we’re in for more volatility and higher interest rates. Again, given his position, he knows what he’s talking about.

One scenario that would require higher rates from the Fed is higher inflation:

If growth in America is accelerating, which it seems to be, and any remaining slack in the labor markets is disappearing – and wages start going up, as do commodity prices – then it is not an unreasonable possibility that inflation could go higher than people might expect.

As a result, the Federal Reserve will also need to raise rates faster and higher than people might expect. In this case, markets will get more volatile as all asset prices adjust to a new and maybe not-so-positive environment.

Now– here’s the important part. For the past ten years, the largest buyer of US government debt was the Federal Reserve.

But now that QE has ended, the US government just lost its biggest lender.

Dimon thinks other major buyers, including foreign central banks, the Chinese, etc. could also reduce their purchases of US government debt.

That, coupled with the US government’s ongoing trade deficits (which will be funded by issuing debt), could also lead to higher rates…

So we could be going into a situation where the Fed will have to raise rates faster and/or sell more securities, which certainly could lead to more uncertainty and market volatility. Whether this would lead to a recession or not, we don’t know.

We’ll leave you with one final point from Jamie Dimon. He acknowledges markets have a mind of their own, regardless of what the fundamentals say.

And he sees a real risk “that volatile and declining markets can lead to a market panic.”

The most powerful banker in the world believes we’ll see more volatility and higher interest rates in the future. And he sees a chance of an all-out panic.

The above was taken from Simon Black’s SovereignMan.com.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Concluding comments

In the words of Sovereign Man Simon Black, ‘Countries whose economic models are based on debt and consumption will suffer’.

When the US does suffer (as Dimon clearly believes it will) it will not be a contained event, the whole world will feel the pinch as we are so intertwined with U.S., their policies and currency.

Another crisis may well be in the pipeline, so bad it is that banks whose models run on debt are giving out warnings. Dimon’s warnings could be a strong signal for investors to allocate a part of their portfolios to gold and silver. These assets have historically held their value in times of economic contraction.

This risk underlines the importance of owning physical gold to protect against geo-political risks, stock and bond market bubbles and the continuing devaluation of the dollar and all fiat currencies.

Recommended reading

Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”

Global Debt Crisis II Cometh

Gold A Store Of Value – Protect From $217 Trillion Global Debt Bubble

News and Commentary

Gold settles lower as trade-war tensions cool, dollar strengthens (MarketWatch.com)

Gold prices drop as U.S.-China trade tensions ease (Reuters.com)

U.S. trade deficit sticks to nearly 10-year high (MarketWatch.com)

ASIA GOLD-India demand up ahead of festival, subdued buying elsewhere (Reuters.com)

N. American gold ETF inflows up in March; Europe saw outflows for second month -WGC (Reuters.com)

Euro-Area Data Maze Leaves Economists Puzzled Over Way Out (Bloomberg.com)

Silver Finally Starts To Catch Up With Gold (SilverSeek.com)

Gold Price Seen ‘Moving North’ as World Fails to Replace Output (Bloomberg.com)

BofA’s Striking Admission: Markets Will Soon Begin To Panic About Debt Sustainability (ZeroHedge.com)

Two Mines Supply Half Of U.S. Silver Production & The Real Cost To Produce Silver (ZeroHedge.com)

Gold Prices (LBMA AM)

05 Apr: USD 1,327.05, GBP 943.67 & EUR 1,080.75 per ounce

04 Apr: USD 1,343.15, GBP 955.52 & EUR 1,092.79 per ounce

03 Apr: USD 1,336.60, GBP 949.65 & EUR 1,085.99 per ounce

29 Mar: USD 1,323.90, GBP 941.69 & EUR 1,075.80 per ounce

28 Mar: USD 1,341.05, GBP 946.24 & EUR 1,082.23 per ounce

27 Mar: USD 1,350.65, GBP 954.64 & EUR 1,087.41 per ounce

26 Mar: USD 1,348.40, GBP 949.27 & EUR 1,086.95 per ounce

Silver Prices (LBMA)

05 Apr: USD 16.31, GBP 11.59 & EUR 13.28 per ounce

04 Apr: USD 16.46, GBP 11.72 & EUR 13.40 per ounce

03 Apr: USD 16.52, GBP 11.78 & EUR 13.44 per ounce

29 Mar: USD 16.28, GBP 11.58 & EUR 13.21 per ounce

28 Mar: USD 16.46, GBP 11.63 & EUR 13.28 per ounce

27 Mar: USD 16.64, GBP 11.79 & EUR 13.41 per ounce

26 Mar: USD 16.61, GBP 11.67 & EUR 13.39 per ounce

Recent Market Updates

– Silver Bullion: Should We Be Worried About Silver?

– Martin Luther King Jr. Anniversary: Reminds Us Of Costs Of War To Society and Financial System

– Gold Outperforms Stocks In Q1, 2018

– Brexit, Stagflation Pressures UK High Street

– Gold Is Money While Currencies Today Are “IOU Nothings”

– “Stars Are Slowly Aligning For Gold” – Frisby

– Uncle Sam Issuing $300 Billion In New Debt This Week Alone

– Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

– Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

– London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

– Global Trade War Fears See Precious Metals Gain And Stocks Fall

– Gold +1.8%, Silver +2.5% As Fed Increases Rates And Trade War Looms

– Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

The post Jamie Dimon Warns Of Potential ‘Market Panic’ appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.