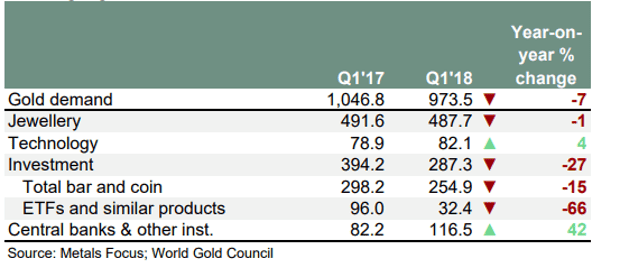

– Gold demand globally -7% in Q1, 2018 – Gold Demand Trends (WGC)

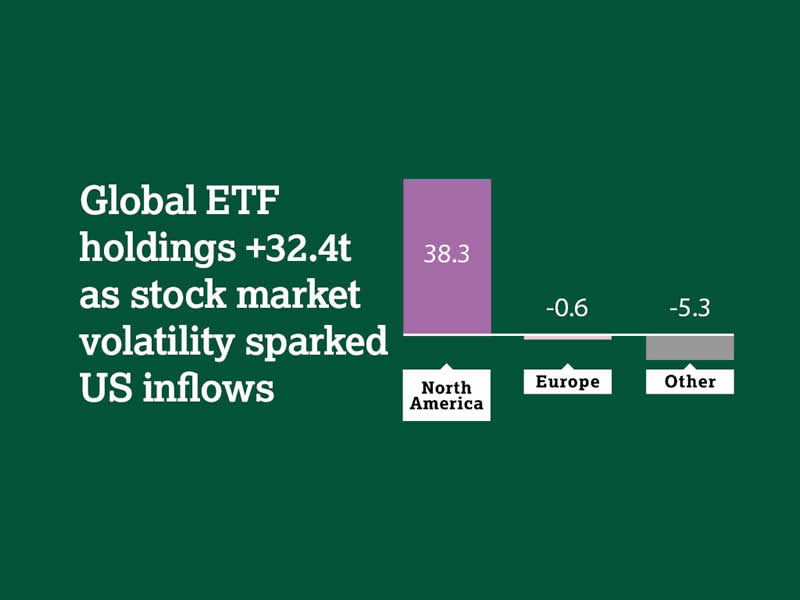

– Gold ETF demand fell sharply year on year from very high levels but had 5th consecutive quarter of inflows

– Investment demand was strong in the US where ETF holdings rose another 32.4 tonnes as “stock market volatility sparked US inflows”

– Store of value bullion coin and bar demand fell 15% as reported Chinese, German and American demand fell

– Gold demand in Turkey (FT) and Iran surges (BBG) due to Trump concerns, inflation on currency debasement and devaluation

– Global jewellery demand was roughly flat at 487.7t

– Technology demand had sixth consecutive quarter of growth

– Central bank demand remains robust at 116.5 tonnes

‘Gold Demand Trends’ is the World Gold Council’s leading industry publication on gold demand trends, analysed by both sector and geography. Read the full report here

News and Commentary

Gold Edges Up Ahead of U.S.-Sino Trade Talks (Reuters.com)

Gold extends gains as dollar weakens after dovish Fed remarks (Reuters.com)

Gold ends at 2-month low, then climbs after Fed statement (MarketWatch.com)

Fed holds rates steady but points to higher inflation (CNBC.com)

American Eagle gold coin sales are weakest April sales level since 2007 (MarketWatch.com)

Gold Eagle Sales Still Faltering While Mining Output Collapses – Perfect Storm (GoldSeek.com)

Gold demand at weakest in first quarter since 2008 financial crisis (TheGuardian.com)

Trump Ire Stokes Gold Trade in Iran as Rial Hits Record Low (Bloomberg.com)

Turkey’s booming inflation and sinking currency boost gold demand (FT.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

01 May: USD 1,309.20, GBP 956.37 & EUR 1,087.68 per ounce

30 Apr: USD 1,316.25, GBP 958.62 & EUR 1,087.62 per ounce

27 Apr: USD 1,317.70, GBP 954.41 & EUR 1,090.79 per ounce

26 Apr: USD 1,321.90, GBP 949.52 & EUR 1,085.94 per ounce

25 Apr: USD 1,325.70, GBP 949.47 & EUR 1,085.48 per ounce

24 Apr: USD 1,327.35, GBP 951.84 & EUR 1,087.76 per ounce

23 Apr: USD 1,328.00, GBP 950.45 & EUR 1,085.64 per ounce

Silver Prices (LBMA)

01 May: USD 16.25, GBP 11.87 & EUR 13.51 per ounce

30 Apr: USD 16.38, GBP 11.93 & EUR 13.54 per ounce

27 Apr: USD 16.53, GBP 12.01 & EUR 13.68 per ounce

26 Apr: USD 16.58, GBP 11.87 & EUR 13.61 per ounce

25 Apr: USD 16.57, GBP 11.87 & EUR 13.57 per ounce

24 Apr: USD 16.60, GBP 11.90 & EUR 13.59 per ounce

23 Apr: USD 16.94, GBP 12.14 & EUR 13.85 per ounce

Recent Market Updates

– “Blood In The Streets” Of U.S. Gold Bullion Market As Sale Of Gold Coins Collapse

– Most Important Chart Of The Century For Investors?

– Gold Mining Shares Are Speculative Making Gold Bullion A Better Investment

– Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

– Cash “Vanishes” From Bank Accounts In Ireland

– Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Gold Reserves

– Family Offices and HNWs Invest In Gold Again

– New All Time Record Highs For Gold In 2019

– Palladium Bullion Surges 17% In 9 Days On Russian Supply Concerns

– Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

– Oil Surges Over 8%, Gold and Silver Marginally Higher, Stocks Gain In Volatile Week

The post Gold Demand Falls In Q1 Despite Robust Central Bank and Investment Demand and Surging Demand In Turkey and Iran appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.