Gold coins, bars see demand rise of 11% in H2, 2017 to 532 tonnes according to WGC Gold Demand Trends

Gold investment demand strong inChina, India & Turkey

Demand in Turkey surges on double digit inflation

Totalgold demand declines in Q2 on slower U.S. ETF inflows

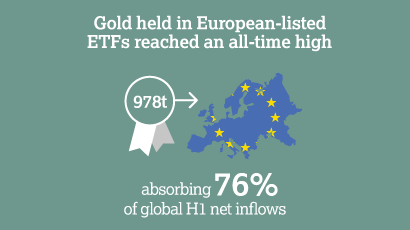

Gold held in ETFs in Europe reached all time high of 978t

U.S. ETF inflows slowed from last year’s record

Central banks continue to buy 94t of declared purchases

Turkey joined Kazakhstan & Russia in buying gold

Well balanced market: ETF inflows continue and jewellery, technology and bar & coin demand up

Important to note this is all official, transparent and recorded demand. There isdemand and flows of gold that cannot be and are not recorded especially into the Middle East, India, Russia and of course China

Key findingsincluded in theGold Demand Trends Q2 2017report are as follows:

- Overall demandwas 953t, a fall of 10% compared with 1,056t in Q2 2016

- Total consumer demandrose by 9% to 722t, from 660t in the same period last year

- Total investment demand (ETFs)fell 34% to 297t compared with 450t in Q2 2016

- Gold coins and barsrebounded13% in H1

- Global jewellery demandgrew 8% to 481t, from 447t in the same period last year

- Central bank demandclimbed 20% to 94t compared with 78t in Q2 2016

- Demand in the technology sectorincreased 2% to 81t compared with 80t in Q2 2016

- Total supplywas down 8% to 1,066t, from 1,160t in the same period last year

- Recyclingfell 18% to 280t compared with 343t in Q2 2016

TheGold Demand Trends Q2 2017report, which includes comprehensive data provided by Metals Focus, can be viewed atGold Demand Trends.

News andCommentary

Dow has its first close above 22,000 (Yahoo.com)

Trump Signs Russia Sanctions Bill, But Lays Out His Concerns About the Law (Bloomberg.com)

Man claims to have found first silver piece minted by the U.S. (CTVNews.ca)

Turks Panic-Buy The Most Gold Ever In July (ZeroHedge.com)

What Is It About 1906ET That Spooks Precious Metals ‘Traders’? (ZeroHedge.com)

Dollar And Equities Will Plunge Together While Gold Spikes (DollarCollapse.com)

Wont Be Long Now Amazon and the New Tech Crash (DailyReckoning.com)

Crypto-currencies are mirroring pre-crash banking systems Kaminska (FT.com)

Gold Prices (LBMA AM)

03 Aug: USD 1,261.80, GBP 952.41 & EUR 1,064.96 per ounce

02 Aug: USD 1,266.65, GBP 956.83 & EUR 1,069.56 per ounce

01 Aug: USD 1,267.05, GBP 957.76 & EUR 1,072.30 per ounce

31 Jul: USD 1,266.35, GBP 965.59 & EUR 1,079.06 per ounce

28 Jul: USD 1,259.60, GBP 961.96 & EUR 1,075.45 per ounce

27 Jul: USD 1,262.05, GBP 960.29 & EUR 1,076.53 per ounce

26 Jul: USD 1,245.40, GBP 956.72 & EUR 1,071.29 per ounce

Silver Prices (LBMA)

03 Aug: USD 16.47, GBP 12.50 & EUR 13.91 per ounce

02 Aug: USD 16.67, GBP 12.60 & EUR 14.09 per ounce

01 Aug: USD 16.74, GBP 12.67 & EUR 14.17 per ounce

31 Jul: USD 16.76, GBP 12.77 & EUR 14.29 per ounce

28 Jul: USD 16.56, GBP 12.66 & EUR 14.15 per ounce

27 Jul: USD 16.79, GBP 12.77 & EUR 14.34 per ounce

26 Jul: USD 16.37, GBP 12.54 & EUR 14.06 per ounce

Recent Market Updates

Greenspan Warns Stagflation Like 1970s Not Good For Asset Prices

What Investors Can Learn From the Japanese Art of Kintsukuroi

Bitcoin, ICO Risk Versus Immutable Gold and Silver

This Is Why Shrinkflation Is Making You Poor

Gold A Good Store Of Value Protect From $217 Trillion Global Debt Bubble

Why Surging UK Household Debt Will Cause The Next Crisis

Gold Seasonal Sweet Spot August and September Coming

Commercial Property Market In Dublin Is Inflated and May Burst Again

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

Time To Position In Gold Is Right Now says Jim Rickards

Bloomberg Silver Price Survey Median 12 Month Forecast Of $20

Bigger Systemic Risk Now Than 2008 Bank of England

ImportantGuides

For your perusal, below are ourmostpopularguidesin 2017:

EssentialGuideTo Storing Gold In Switzerland

EssentialGuideTo Storing Gold In Singapore

EssentialGuideto Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

The post Gold Coins and Bars See Demand Rise of 11% in H2, 2017 appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.