U.S. Mint American Eagle gold coin sales collapse to weakest April since 2007 giving contrarian value buyers another buy signal

Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday.

The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25 percent from the year prior. However, April sales were up 29 percent from March.

During April, spot gold prices rallied to a 2-1/2-month high of $1,365.23 per ounce as concerns over escalating tensions in Syria, U.S. Sanctions on Russia and the U.S.-China trade stand-off weighed on stock markets and helped to knock the dollar index to a two-week low against a basket of currencies.

But later in the month, spot gold prices dipped after the Federal Reserve said the U.S. economy remained on track for continued growth and signaled more interest rate hikes for the year.

Higher interest rates make gold a less appealing asset to investors since it does not draw interest.

U.S. retail investors have also gradually lost their appetite for physical gold as buoyant stock markets offered tempting alternatives, and more coins were being sold back onto the market, further eroding demand for newly minted products.

The U.S. Mint sold 915,000 ounces of American Eagle silver coins in April, the data showed, unchanged from March. April silver coin sales were 9.6 percent higher than in 2017.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

News and Commentary

U.S. Mint American Eagle gold coin sales at weakest April since 2007 (Reuters.com)

Gold inches down as dollar stays firm near 3-1/2-month peak (Reuters.com)

Stocks in Japan Trade Mixed; Dollar Holds Gains (Bloomberg.com)

U.S. Stocks Start Busy Earnings Week on Down Note (Bloomberg.com)

Pending-home sales crawl higher as inventory shortage turns urgent (MarketWatch.com)

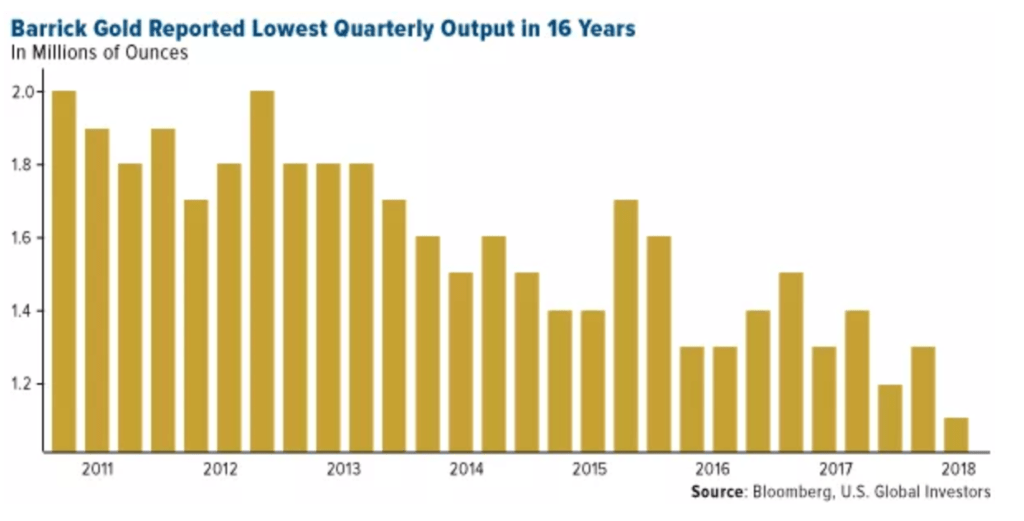

Source: Frank Holmes & US Global Investors via Palisade

SWOT Analysis: Gold Continues Moving West to East (GoldSeek.com)

Gold Demand Grows While Mine Supply Declines (Palisade-research.com)

Savers are Just Collateral Damage (Monetary-Metals.com)

Syrian Army: “Enemy” Rockets Strike 2 Bases, 11 Iranians Killed (ZeroHedge.com)

Chinese Smartphone Sales Collapse In “Biggest Decline Ever” (ZeroHedge.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

30 Apr: USD 1,316.25, GBP 958.62 & EUR 1,087.62 per ounce

27 Apr: USD 1,317.70, GBP 954.41 & EUR 1,090.79 per ounce

26 Apr: USD 1,321.90, GBP 949.52 & EUR 1,085.94 per ounce

25 Apr: USD 1,325.70, GBP 949.47 & EUR 1,085.48 per ounce

24 Apr: USD 1,327.35, GBP 951.84 & EUR 1,087.76 per ounce

23 Apr: USD 1,328.00, GBP 950.45 & EUR 1,085.64 per ounce

20 Apr: USD 1,340.15, GBP 953.52 & EUR 1,089.14 per ounce

Silver Prices (LBMA)

30 Apr: USD 16.38, GBP 11.93 & EUR 13.54 per ounce

27 Apr: USD 16.53, GBP 12.01 & EUR 13.68 per ounce

26 Apr: USD 16.58, GBP 11.87 & EUR 13.61 per ounce

25 Apr: USD 16.57, GBP 11.87 & EUR 13.57 per ounce

24 Apr: USD 16.60, GBP 11.90 & EUR 13.59 per ounce

23 Apr: USD 16.94, GBP 12.14 & EUR 13.85 per ounce

20 Apr: USD 17.11, GBP 12.15 & EUR 13.91 per ounce

Recent Market Updates

– Most Important Chart Of The Century For Investors?

– Gold Mining Shares Are Speculative Making Gold Bullion A Better Investment

– Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

– Cash “Vanishes” From Bank Accounts In Ireland

– Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Gold Reserves

– Family Offices and HNWs Invest In Gold Again

– New All Time Record Highs For Gold In 2019

– Palladium Bullion Surges 17% In 9 Days On Russian Supply Concerns

– Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

– Oil Surges Over 8%, Gold and Silver Marginally Higher, Stocks Gain In Volatile Week

– EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

The post “Blood In The Streets” Of U.S. Gold Bullion Coin Market appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.