Research Director of GoldCore and respected precious metals commentator Mark O’Byrne and GoldCore CEO Stephen Flood in discussion with Dave Russell in Episode 6 of the Goldnomics Podcast.

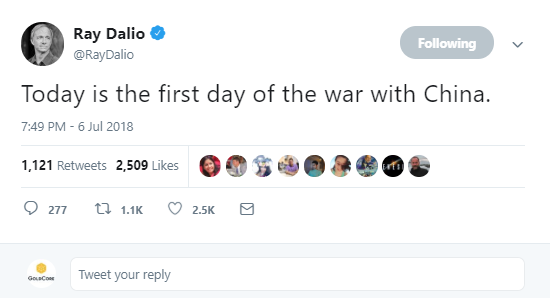

We discuss the “Tweet” of Ray Dalio, the founder of hedge fund Bridgewater Associates,: “Today is the first day of war with China.”

The tweet from the founder of the world’s largest hedge fund, which manages some $160 billion, comes after the U.S. slapped levies on some of China’s exports to the U.S., and President Donald Trump threatened further action.

Is he suggesting that there is something more than just a Trade War brewing between the U.S and China?

Is he warmongering, is he suggesting that Donald Trump is warmongering, or is he just alluding to what the unintended consequence of a trade war could be, as we have seen throughout history?

Is this part of Trump’s goal to Make America Great Again? We look at the serious unintended consequences of these actions. We look at the backdrop to these trade wars and how Globalization can be a double edged sword and how Ray Dalio is “right to be concerned.”

Listen to the full episode or skip directly to one of the following discussion points:

2:52: Why a trade war, why now?

4:22: The effects of a mass migration of Chinese from agriculture to trade and industry.

4:27 What effect does globalization have on the work-force

5:04: How China leverage their cheap labour force as a international competitive advantage.

5:22: Imported Chinese Goods are cheaper than the goods that are being domestically produced in America, how is this effecting peoples’ jobs in America.

5:40: Are Chinese workers now competing with the Vietnamese workers?

6:04: How Trump’s intention to safeguard American manufacturers and workers may cause the American consumers to pay more for domestically produced goods instead of buying cheaper imported goods

8:06 The U.S. has a Deficit with 140 countries around the world, why this can’t be fixed with a trade war.

8:30: History suggests that trade war initiates currency wars which eventually result in actual wars.

9.00: Hawks versus Doves: Hawks are increasingly in the ascendant in Trump’s America

12:45: Nationalism on the rise in America: “USA, USA, USA!”

13:30: “To jaw-jaw is always better than to war-war” Winston Churchill

14.27: Unforeseeable consequences warned of by Churchill: “The Statesman who yields to war fever must realize that once the signal is given, he is no longer the master of policy, but the slave of unforeseeable and uncontrollable events. Let us learn our lessons.”

15:10: What is the response of China?

15:11 How Trump’s action to protect the domestic industries and workers is not just targeting China but also involving Europe and Canada as well

16:14: Why Trump’s supporters continue to back his actions and decisions

17:36 How the European Union is responding

17:50 Harley Davidson and the unintended consequence playing out.

18:00 How Trump’s actions to protect domestic jobs are resulting in the contrary

18:41 How Trade War will add an extra premium to the cost of doing business all over the world

19:05 Why China is putting more and more money in Infrastructure & Power Systems so they can easily get their goods to the market

20:52 Behind the scenes of trade war, is a currency war actually going on?

21:52 Why are the Chinese continuing to quietly invest in Gold

22:22 The Chinese government are planning for the long term, unlike the U. S. government

23:26: How the personal prosperity of Americans is diminishing while certain corporations continue to do better

23:44: Trump’s actions to protect jobs are reflected in his suggested policies

24:34 Why globalization is not delivering security to individuals and their families

24:41: Historically trade wars were the portent of an actual war

27:00 Why the media’s mocking actions are encouraging the trade war

29:10 How Europe’s massive global economy has an important role to play in this trade war

29:38: What action might the investors and savers take in this situation?

32:08 Trump’s actions until now only focusing on the short term protection of the U.S. economy

32:47: Why investors need to diversify their investments and re-balance portfolios

33:07: Why diversification needs to be geographical and not just asset based

33:54 How gold can be used to protect wealth in trade wars or actual wars

35:17 Ray Dalio’s Tweet doesn’t necessarily signify the first day of war with China but there’s definitely a trade war going on between U.S. & China and as the gloves come off, we could see unintended consequences…

People mentioned in this episode:

Ray Dalio: https://twitter.com/RayDalio

Harald Malmgren: https://twitter.com/Halsrethink

Pippa Malmgren: https://twitter.com/DrPippaM

Gerald Celente: https://twitter.com/geraldcelente

News and Commentary

PRECIOUS-Gold rises further as U.S. dollar eases (Reuters.com)

Doubts raised over Russian treasure ship with $190 billion in gold (News.com)

Trump warns Iran’s President Rouhani: ‘NEVER, EVER THREATEN THE UNITED STATES AGAIN’ (CNBC.com)

EU warns of Brexit crash (Reuters.com)

Italian Markets Rattled After Tria’s Future Is Thrown Into Doubt (Bloomberg.com)

Currency War Erupts, Threatening to Ripple Across Global Markets (Bloomberg.com)

London’s luxury new-build property is in big trouble (MoneyWeek.com)

Almost 70% of millennials regret buying their homes. Here’s why (CNBC.com)

Global Economy Lives on the Edge as Crisis Veterans Sound Alarms (Bloomberg.com)

The Case For Gold Is Not About Price (ZeroHedge.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

20 Jul: USD 1,224.85, GBP 940.56 & EUR 1,050.80 per ounce

19 Jul: USD 1,217.40, GBP 936.06 & EUR 1,048.79 per ounce

18 Jul: USD 1,223.45, GBP 938.02 & EUR 1,052.29 per ounce

17 Jul: USD 1,243.65, GBP 938.46 & EUR 1,059.96 per ounce

16 Jul: USD 1,244.90, GBP 938.41 & EUR 1,063.52 per ounce

13 Jul: USD 1,240.50, GBP 945.14 & EUR 1,066.83 per ounce

Silver Prices (LBMA)

20 Jul: USD 15.37, GBP 11.79 & EUR 13.19 per ounce

19 Jul: USD 15.26, GBP 11.75 & EUR 13.16 per ounce

18 Jul: USD 15.44, GBP 11.85 & EUR 13.29 per ounce

17 Jul: USD 15.77, GBP 11.91 & EUR 13.46 per ounce

16 Jul: USD 15.81, GBP 11.90 & EUR 13.49 per ounce

13 Jul: USD 15.81, GBP 12.04 & EUR 13.60 per ounce

Recent Market Updates

– Weekly Digest – News, Market Updates and Videos You May Have Missed

– Financial Terrorism In The UK – Collusion between Government, Regulators & Two Bailed-Out UK Banks

– “Biggest Bubble in the History of Mankind” Is “Going To Burst” – Ron Paul

– Global Debt Time Bomb Surges To Nearly $250,000,000,000,000 – GoldCore Video

– Trump, Russia, Brexit and the Demand For Gold and Silver – GoldCore Video Interview

– Trump Is Serious About A Global Trade War

– Ponzi Economy Will Lead To Next Global Financial Crisis

– World Cup Is 200 Ounces Of Gold Worth £140,000 – 30% Less Than Harry Kane’s Weekly Wage

– Chaotic BREXIT More Likely: Risk To London, While Frankfurt, Luxembourg, Paris and Dublin Benefit

– VIDEO: Italy €2.4 Trillion Debt To Create Eurozone Contagion and Global Debt Crisis?

– U.S. China Trade War Escalates as Russia and China Accumulate Gold

– Irish Gold Money Rings Found – Mystery Surrounds What May Be Ancient, Pre-Historic Currency

The post Trump and War With China? Goldnomics Podcast appeared first on GoldCore Gold Bullion Dealer.

![]()