– London house prices fall at the fastest annual rate since height of the financial crisis

– London house prices fall in 5th month in row, worst falls since 2009

– London rents dropped at the fastest rate in eight years – ONS

– Brexit, London property slump put brake on UK house price growth

– Consumer spending declined in July as inflation increased

UK house price growth slowed in June to the lowest annual rate in five years according to official figures, likely driven by falling prices in London, Brexit and increasing economic and geo-political uncertainty.

The property slowdown is hitting London hardest. House prices in London fell at the fastest annual rate since the height of the financial crisis, while rents dropped at the fastest rate in eight years, according to the ONS.

The UK’s annual house price growth rate has been on a downward trajectory since mid-2016.

Average house prices across the country increased just 3% in the year to June, down from a 3.5% gain in May, the lowest annual rate since August 2013, the Office for National Statistics (ONS) said.

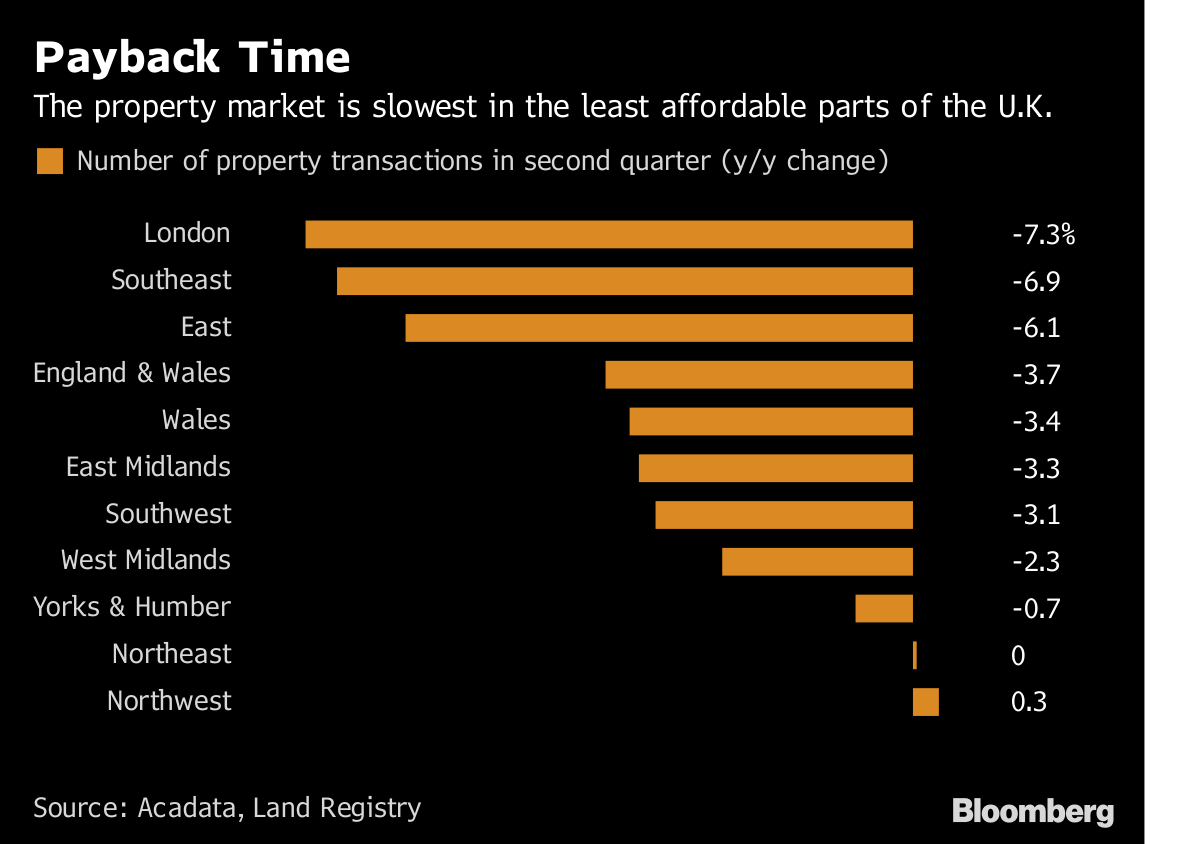

The UK-wide dip in growth was driven mainly by a slowdown in the south and east of England.

London recorded the weakest reading across the country, with prices dropping 0.7% over the year to June, the lowest rate since September 2009, and down 0.2% in May. It is the fifth month London house prices have fallen this year and there is a sharp decline in transactions in the capital (see above).

Inflation in the UK increased in July for the first time this year, leaving many British households feeling squeezed by prices that are rising as fast or faster than their salaries.

Consumer spending fell 0.9% in July from a year earlier according to a report from Visa and IHS Markit. Retailers are concerned that interest rate hikes will hit already-fragile consumer confidence.

Editors Note: The London house price bubble appears to be bursting and this is now impacting the wider UK housing market.

The questions not being asked are how far prices will fall and will this be a relatively mild correction, a sharp correction or indeed another property crash?

Property investors should consider diversifying into safe-haven gold which will again hedge and protect investors from a sharp correction or indeed a property crash.

Related Content

London House Prices Fall 1.9% In Quarter – Bubble Bursting?

London Property Bubble Bursting?

Is London’s Property Bubble Set To Burst?

London Property Market Vulnerable To Crash

News and Commentary

Gold hits 18-month low as dollar flares on Turkey woe (Reuters.com)

Asian markets retreat, weighed by sinking tech stocks (MarketWatch.com)

Dow snaps 4-day slide as Turkish lira rebounds (CNBC.com)

U.S. import prices flat; dollar curbing imported inflation (Reuters.com)

U.K. House Prices Are on the Longest Losing Streak Since Crisis (Bloomberg.com)

Source: Bloomberg via ZH.com

What do Turkey, Italian debt and falling global house prices have in common? (MoneyWeek.com)

Big Move Is Coming in the Italian Bond Market, BofAML Says (Bloomberg.com)

“Good News” From Venezuela (BonnerAndPartners.com)

Why Elon Musk’s $420 tweet could signal gloom for the stock market (MarketWatch.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

14 Aug: USD 1,195.30, GBP 935.32 & EUR 1,049.11 per ounce

13 Aug: USD 1,204.40, GBP 944.85 & EUR 1,058.19 per ounce

10 Aug: USD 1,211.65, GBP 947.87 & EUR 1,056.44 per ounce

09 Aug: USD 1,215.50, GBP 944.08 & EUR 1,048.13 per ounce

08 Aug: USD 1,212.35, GBP 939.57 & EUR 1,045.17 per ounce

07 Aug: USD 1,215.40, GBP 937.32 & EUR 1,048.77 per ounce

Silver Prices (LBMA)

14 Aug: USD 15.04, GBP 11.77 & EUR 13.18 per ounce

13 Aug: USD 15.18, GBP 11.91 & EUR 13.35 per ounce

10 Aug: USD 15.37, GBP 12.04 & EUR 13.41 per ounce

09 Aug: USD 15.48, GBP 12.01 & EUR 13.35 per ounce

08 Aug: USD 15.35, GBP 11.93 & EUR 13.24 per ounce

07 Aug: USD 15.47, GBP 11.93 & EUR 13.34 per ounce

06 Aug: USD 15.35, GBP 11.86 & EUR 13.30 per ounce

Recent Market Updates

– Jim Rogers on Gold, Silver, Bitcoin and Blockchain’s “Spectacular Future”

– The Stock Market is Stretched to Double Tech-Bubble Extremes

– Jim Rogers and the World’s New Reserve Currency

– Gold-Even at its Lowest Levels in 2018-is Behaving Just as Prescribed

– Jim Rogers – Making China Great Again! (Video)

– Gold to Enter New Bull Market – Charles Nenner

– Here’s Where the Next Crisis Starts

– House prices aren’t just slipping in the UK – this is global

– Russia Sells 80% Of Its US Treasuries

– Are China’s Gold Reserves Slowly Rising?

– Gold Production In South Africa Continues To Collapse – Plummets 85% From Peak In 1970 (VIDEO)

– Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

– Trump and War With China? Goldnomics Podcast

The post London House Prices Fall At Fastest Rate Since Height Of Financial Crisis appeared first on GoldCore Gold Bullion Dealer.

![]()