– London house prices down 1.9 per cent in Q2 (yoy)

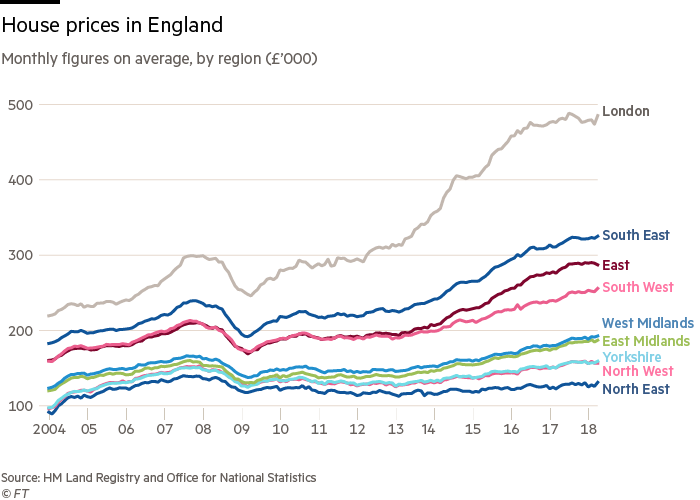

– London house prices still 50% above 2007 bubble peak (see chart)

– Brexit and weak consumer confidence to blame say experts

– Little sign that U.K. property “weakness” is likely to change

– London property bubble appears to be bursting

From Bloomberg:

U.K. house-price growth has slowed to the weakest pace in five years, while London values are falling, according to Nationwide Building Society.

The lender said the “subdued economic activity” and squeezed household budgets are keeping a lid on demand, and the national market is unlikely to see any change to the recent trend in the near term.

From City AM:

London weakness

The capital was the weakest performing region across the board for the second quarter of the year, with Nationwide reporting London house prices were down 1.9 per cent year-on-year, down from the one per cent fall posted in the first quarter.

“But despite the recent underperformance, prices in the capital are still more than 50 per cent above their 2007 peak, while prices in the UK overall are only 15 per cent higher,” Gardner pointed out.

“There are few signs of an imminent change. Surveyors continue to report subdued levels of new buyer enquiries, while the supply of properties on the market remains more of a trickle than a torrent.

Looking further ahead, much will depend on how broader economic conditions evolve, especially in the labour market, but also with respect to interest rates.”

Editors Note: The London property bubble appears to be in the early stages of bursting. House prices are falling with reports of falls of as much as 15% in some London markets.

The question not being asked is how far prices will fall and will this be a relatively mild correction, a sharp correction or indeed another property crash?

We have long contended that London house prices would crash. The mantra that London is “unique” and “this time is different” is faulty given the massive over valuation in the London property market. This massive over valuation in conjunction with the fragile nature of the massively indebted UK consumers, corporates, banks and government and the many geo-political risks looming over the London and the UK including Brexit makes a crash more and more likely.

A crash in London property prices has obvious ramifications for the rest of the UK property market and other property markets. Psychology is a powerful thing and a crash in leading financial capital London will likely curb property investors enthusiasm for other over valued and frothy property markets including Toronto, Vancouver, Sydney, Melbourne, Perth, San Francisco, Los Angeles, Amsterdam, Frankfurt, Paris and Dublin.

Property investors should consider diversifying into safe haven gold which will again hedge and protect investors in a crash.

Related Content

London Property Bubble Bursting?

Is London’s Property Bubble Set To Burst?

London Property Market Vulnerable To Crash

Never miss an episode of The Goldnomics Podcast – Listen and subscribe on YouTube, ITunes, Soundcloud or Blubrry

News and Commentary

Gold prices hover near six-month low as dollar firms (Reuters.com)

Asian Stocks Fall on Trade; Crude Extends Rally (Bloomberg.com)

Consumer confidence falls in June despite expectations for gains (CNBC.com)

Markets gipped by trade war fears; London house prices fall (TheGuardian.com)

London house prices down 1.9% in last quarter (CityAM.com)

Source: FT

Russia And China Are Stockpiling Gold (ZeroHedge.com)

Where The Rich Park Their Money (ZeroHedge.com)

Expect global trade tensions to get worse before they get better (MoneyWeek.com)

Once a Trump Favorite, Harley Now Feels the Pinch From Trade War (Bloomberg.com)

Crypto Collapse Spreads With Hundreds of Coins Plunging in Value (Bloomberg.com)

Gold’s Haven Luster Fades … For Now (Bloomberg.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

26 Jun: USD 1,257.15, GBP 949.15 & EUR 1,077.63 per ounce

25 Jun: USD 1,269.80, GBP 959.46 & EUR 1,090.25 per ounce

22 Jun: USD 1,269.70, GBP 954.05 & EUR 1,088.26 per ounce

21 Jun: USD 1,263.70, GBP 963.32 & EUR 1,096.51 per ounce

20 Jun: USD 1,273.25, GBP 967.29 & EUR 1,100.60 per ounce

19 Jun: USD 1,279.00, GBP 971.14 & EUR 1,108.89 per ounce

18 Jun: USD 1,281.25, GBP 966.96 & EUR 1,103.93 per ounce

Silver Prices (LBMA)

26 Jun: USD 16.23, GBP 12.25 & EUR 13.90 per ounce

25 Jun: USD 16.38, GBP 12.35 & EUR 14.05 per ounce

22 Jun: USD 16.43, GBP 12.35 & EUR 14.11 per ounce

21 Jun: USD 16.25, GBP 12.33 & EUR 14.07 per ounce

20 Jun: USD 16.29, GBP 12.38 & EUR 14.09 per ounce

19 Jun: USD 16.36, GBP 12.42 & EUR 14.16 per ounce

18 Jun: USD 16.61, GBP 12.53 & EUR 14.29 per ounce

Recent Market Updates

– London House Prices Fall 1.9% In Quarter – Bubble Bursting?

– Gold Exports To London From U.S. Surge 152% In 2018

– Manipulation of Gold & Silver by Bullion Banks Is “Undeniable”

– “Perfect Environment For Gold” As Fed Will Weaken Dollar and Create Inflation – Rickards

– Russia Buys 600,000 oz Of Gold In May After Dumping Half Of US Treasuries In April

– In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast with Ronald-Peter Stoeferle

– Own A “Bit Of Gold” As We Are Moving Ever Closer To A Trade War

– Bitcoin Price To $0 Or $1 Million In One Year? MoneyConf 2018 Poll

– Cashless Society – Good or Bad? MoneyConf 2018 Video

– Do We Still Need Banks In The Age Of Fintech?

– Total US Government Debt Is $200 Trillion – Debt Clock Ticking To Next Crisis

– All Gold is Not Equal – Goldnomics Podcast (Episode 4)

– “Without Gold I Would Have Starved To Death” – ECB Governor

– Swiss Government Pension Fund To Buy Gold Bars Worth Some €600 Million

The post London House Prices Fall 1.9% In Quarter – Bubble Bursting? appeared first on GoldCore Gold Bullion Dealer.

![]()