Jim Rogers, legendary investor and “Adventure Capitalist” speaks with Mark O’Byrne, GoldCore’s Director of Research, in the Goldnomics Podcast (Episode 7).

Are the actions of the US administration making China great again? What currency is going to challenge the US dollar as the global reserve? What can we do to protect ourselves against the next financial crash?

Key insights:

– Blockchain “has a spectacular future”

– “Blockchain is going to change everything” and “a lot of people are going to lose their jobs”

– “I don’t suspect cryptocurrencies are going to survive”

– Bitcoin and cryptocurrencies will be suppressed by governments

– Crypto currency guys are smarter than “every governments you can think of” but the “governments have the guns”

– Governments favour government digital currency and “love the fact that it gives them total control”

– Everybody should have a “Plan B” in the 21st Century and be willing to move country, residence and diversify investments internationally

– Gold and silver “are going to be huge bubbles” and favors silver as is “more depressed”

– Switzerland, Austria and Singapore are his bullion storage locations of choice

– “Everybody should own some gold and silver”

Listen on Blubrry, Soundcloud and iTunes. Watch on YouTube below

Skip directly to one of the following discussion points on YouTube

01:00 – Meet Jim Rogers: Best-selling author, traveler, finance expert and investment guru.

03:30 – Looking at the facts and potential, is the 21st century truly an Asian century?

05:00 – Are Trump’s policies right for the American economy?

06:10 – Increasing global debt and the potential for stagflation, depression and trade conflicts around the world.

08:10 – Unreported off balance sheet debt and other liabilities, and the most recent Institute for International Finance global debt report – should we be worried?

10:05 – It’s global debt, we all owe it to each other. Should we be concerned?

11:10 – Are central banks powerful enough to keep debts at manageable levels?

11:52 – Can we trust the dollar as a store of value down the road?

13:06 – Brexit and other eurozone conflicts: Is the euro safe?

14:11 – Is the Euro properly structured and sound enough to survive the EU conflicts?

15:00 – The Chinese renminbi looks set to take over as the next best international reserve currency.

17:53 – The future of cryptocurrency and blockchain technology.

19:01 – Bitcoin and most other cryptocurrencies may not survive into the future because government have the guns and government don’t like losing control.

20:10 – Future digital currencies is going to most likely be government money.

22:22 – Gold and silver “are going to be huge bubbles” and favors silver as is “more depressed”

25:50 – Picking the best location to store or own your gold.

26:23 – What do precious metals owners know that other investors don’t know?

29:01 – Learn Mandarin as a first, second or third language and know about the world.

30:28 – Everybody needs to have a Plan B just in case.

Make sure you don’t miss a single episode… Subscribe to Goldnomics Podcasts on iTunes or on YouTube

Gold and Silver Bullion – News and Commentary

Gold stabilises as dollar pulls back from 13-month high (Reuters.com)

Nikkei leads Asian-market rebound following Turkish currency jitters (Marketwatch.com)

Investors Ask `Why Do I Need Gold?’ Amid Rate Hikes, Stock Rally (Bloomberg.com)

Turkish lira pulls back from record low, markets rattled (Reuters.com)

Turkey’s Collapse Sinks Emerging Markets on ‘Manic Monday’ (Bloomberg.com)

Ray Dalio’s Bridgewater Keeps Faith in Gold Despite Its Slide (Bloomberg.com)

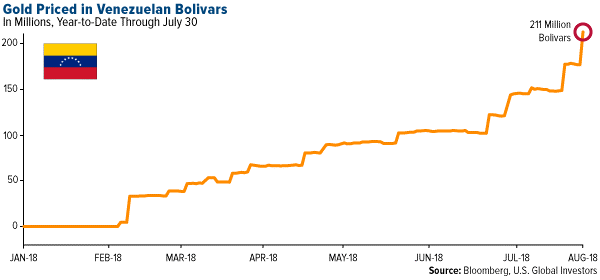

Source: US Global Investors via Gold Eagle

Gold Tumbles Below $1200 In Welcome Sign For Global Contagion (Zerohedge.com)

Kim Dotcom Warns Of Economic Collapse – Says “Buy Gold And Bitcoin” (Zerohedge.com)

Spectacular Gold CoT Report Forecasts A Huge Six Months Ahead (DollarCollapse.com)

ECB Fears Contagion from Turkish Lira Collapse, Bank Stocks Plunge (WolfStreet.com)

Wait Until You See The Price Of Gold In Venezuela Right Now (Gold-Eagle.com)

What happens if we end up with a no-deal Brexit (Moneyweek.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

13 Aug: USD 1,204.40, GBP 944.85 & EUR 1,058.19 per ounce

10 Aug: USD 1,211.65, GBP 947.87 & EUR 1,056.44 per ounce

09 Aug: USD 1,215.50, GBP 944.08 & EUR 1,048.13 per ounce

08 Aug: USD 1,212.35, GBP 939.57 & EUR 1,045.17 per ounce

07 Aug: USD 1,215.40, GBP 937.32 & EUR 1,048.77 per ounce

06 Aug: USD 1,212.00, GBP 934.94 & EUR 1,048.26 per ounce

03 Aug: USD 1,207.70, GBP 928.60 & EUR 1,042.97 per ounce

Silver Prices (LBMA)

13 Aug: USD 15.18, GBP 11.91 & EUR 13.35 per ounce

10 Aug: USD 15.37, GBP 12.04 & EUR 13.41 per ounce

09 Aug: USD 15.48, GBP 12.01 & EUR 13.35 per ounce

08 Aug: USD 15.35, GBP 11.93 & EUR 13.24 per ounce

07 Aug: USD 15.47, GBP 11.93 & EUR 13.34 per ounce

06 Aug: USD 15.35, GBP 11.86 & EUR 13.30 per ounce

03 Aug: USD 15.36, GBP 11.81 & EUR 13.26 per ounce

02 Aug: USD 15.45, GBP 11.78 & EUR 13.29 per ounce

Recent Market Updates

– The Stock Market is Stretched to Double Tech-Bubble Extremes

– Jim Rogers and the World’s New Reserve Currency

– Gold-Even at its Lowest Levels in 2018-is Behaving Just as Prescribed

– Jim Rogers – Making China Great Again! (Video)

– Gold to Enter New Bull Market – Charles Nenner

– Here’s Where the Next Crisis Starts

– House prices aren’t just slipping in the UK – this is global

– Russia Sells 80% Of Its US Treasuries

– Are China’s Gold Reserves Slowly Rising?

– Gold Production In South Africa Continues To Collapse – Plummets 85% From Peak In 1970 (VIDEO)

– Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

– Trump and War With China? Goldnomics Podcast

The post Jim Rogers on Gold, Silver, Bitcoin and Blockchain’s “Spectacular Future” appeared first on GoldCore Gold Bullion Dealer.

![]()