– New all time record highs for gold in 2019

– ‘Powerful bull market’ will likely send gold to $5,000 to $10,000

– If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’

– Traditional portfolio of stocks and bonds will not protect investors

– “Gold will replace bonds as the go-to hedge”

by Brian Delaney of Secure Investments

Gold is gaining momentum after a 5-year consolidation and is set to challenge the 2011 highs some time next year. Once gold clears $2,000, a powerful bull market should drive the gold price meaningfully higher.

Gold has been an unloved asset class for years but that is about to change. I am expecting a bear market in equities and rising yields as a consequence of years of central bank QE.

A traditional portfolio of stocks and bonds will not protect investors during the next downturn. I expect gold will replace bonds as the go-to hedge.

Ultimately, I think gold will reach $5,000/oz-$10,000/oz, as a multi-year bear market in equities and the USD unfolds (along with a USD currency crisis), but let’s get to $2,000/oz first.

Should gold continue on its bullish trajectory, the gold (and silver) miners will explode higher.

$XAU is an index of gold and silver mining companies, and are they on sale today, following a catastrophic collapse from 2011 to 2016. Miners are cheaper today than they were all the way back in 2000 when the gold bull market began (and gold was trading at $250/oz). Many gold and silver mining companies are now breaking out from multi-year base formations.

Fortunes will be made in this sector over the next 5-10 years.

Last Friday, I reviewed the performance of US equities, bonds and USD in the run up to the 1987 stock market crash to see if there are any similarities to today’s markets.

From 1981 to 1986, US equities and bonds went on a tear. The S&P 500 rallied +237% from 1982 to 1987, while bonds surged +84% higher. The USD ran up +68% and then collapsed -42%. The combination of an overvalued stock market, overly bullish investor sentiment, a collapsing currency and automatic trading programmes in place at the time resulted in the panic now known as Black Monday.

Today, stocks are more expensive, debt levels are much higher across the board and interest rates are much lower too. The US stock market has rallied +167% from 2012 to 2018. US Treasuries added almost +40% from 2013 to 2016 before falling -20% over the last two years. The USD added +32% from 2013 to 2017 before declining -15% over the last 15 months.

Investors with a bullish bias should be rooting for both US Treasuries and USD to stabilize. If the USD and Treasuries continue to fall, the stock market will surely follow and the decline could accelerate at a moment’s notice.

Silver has been in a trading range for over four years and is now preparing to launch higher. More volatile than gold, silver is also considered a precious metal and the upside potential from here is significant. Silver cleared $17 yesterday. I think $18 and $20 will fall shortly as the next leg of the precious metals bull market gets underway. Just as I expect gold to break out to new all time highs next year above $2,000/oz, silver has a good chance of doing the same.

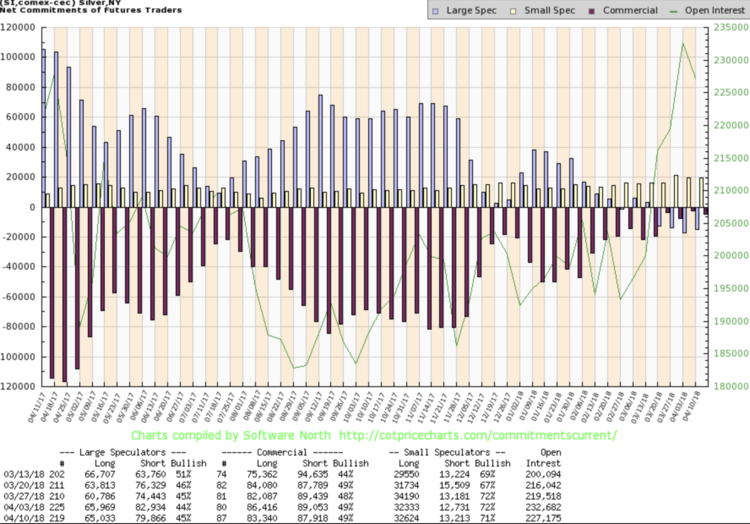

The latest Commitment of Traders report is also favouring a sharp move higher in silver prices. The Commercial Traders (smart money, purple bars) who are always short the metal to hedge silver producer production, are holding their smallest short position in years.

Meanwhile, the Large Speculator position (blue bars) is now short silver for the first time in years. The scene is set for a rocket launch in silver prices.

by Brian Delaney, CFA of Secure Investments

Recent Market Updates

– Palladium Surges 17% In 9 Days On Russian Supply Concerns

– Silver Remains Good Value On Positive Supply And Demand Factors

– London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

– Oil Surges Over 8%, Gold and Silver Marginally Higher, Stocks Gain In Volatile Week

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube above

News and Commentary

Gold prices inch down as global political tensions ease (Reuters.com)

U.S. Leading Economic Index Rises In Line With Estimates In March (Nasdaq.com)

Commodities Rally as Metals Surge; Bonds Slide (Bloomberg.com)

Philly Fed manufacturing index points to continued growth in April (MarketWatch.com)

U.S. weekly jobless claims dip in latest week (Reuters.com)

Don’t Wait Too Long to Leave the Party (DailyReckoning.com)

Russia And Iran Complete First Oil-For-Goods Transfer, Extend Agreement For A Year (ZeroHedge.com)

More Signs Of Inflation: Home Prices Jump Again And “$3 Gas Is Coming” (GoldSeek.com)

Sweden’s Very Own Bitcoin. What Could Possibly Go Wrong? (Bloomberg.com)

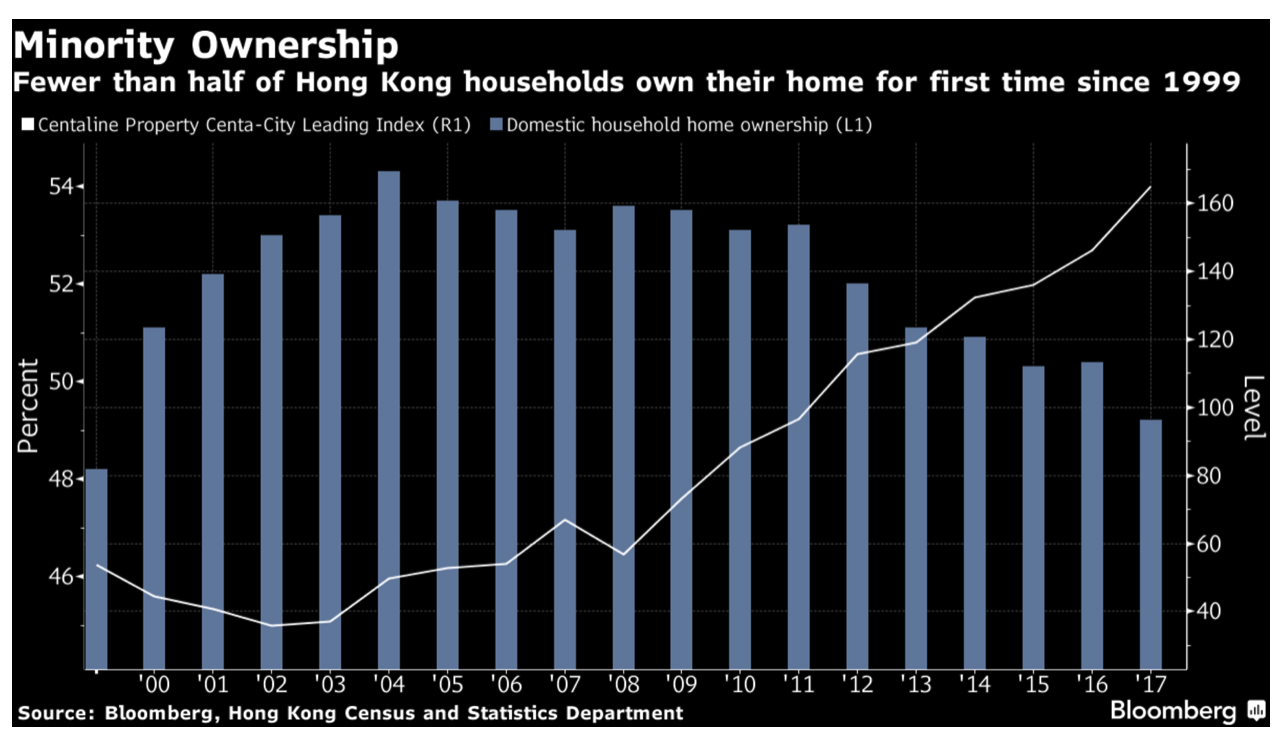

Hong Kong Home Owners Now a Minority as Prices Keep on Rising (Bloomberg.com)

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

19 Apr: USD 1,347.90, GBP 950.54 & EUR 1,090.59 per ounce

18 Apr: USD 1,346.55, GBP 949.59 & EUR 1,088.95 per ounce

17 Apr: USD 1,342.95, GBP 937.24 & EUR 1,084.57 per ounce

16 Apr: USD 1,344.40, GBP 941.21 & EUR 1,087.62 per ounce

13 Apr: USD 1,340.75, GBP 938.93 & EUR 1,087.35 per ounce

12 Apr: USD 1,345.90, GBP 951.01 & EUR 1,090.99 per ounce

Silver Prices (LBMA)

19 Apr: USD 17.20, GBP 12.09 & EUR 13.91 per ounce

18 Apr: USD 16.95, GBP 11.93 & EUR 13.70 per ounce

17 Apr: USD 16.63, GBP 11.60 & EUR 13.44 per ounce

16 Apr: USD 16.60, GBP 11.61 & EUR 13.42 per ounce

13 Apr: USD 16.51, GBP 11.57 & EUR 13.40 per ounce

12 Apr: USD 16.66, GBP 11.74 & EUR 13.50 per ounce

Recent Market Updates

– Palladium Bullion Surges 17% In 9 Days On Russian Supply Concerns

– Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

– Oil Surges Over 8%, Gold and Silver Marginally Higher, Stocks Gain In Volatile Week

– EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– Trump Tweets Russia “Get Ready” For Missiles In Syria – Gold, Oil Rise and Stocks Fall

– Private: EU and Euro Exposed To Trade Wars, Energy Dependence, Anti-EU and Anti-Euro Movements

– Trump Making ‘Major Decisions’ on Syria, Iran and Russia Response ‘Very Quickly’

– Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

– Jamie Dimon Warns Of Potential ‘Market Panic’

– Silver Bullion: Should We Be Worried About Silver?

– Martin Luther King Jr. Anniversary: Reminds Us Of Costs Of War To Society and Financial System

The post New All Time Record Highs For Gold In 2019 appeared first on GoldCore Gold Bullion Dealer.

![]()

Leave A Comment

You must be logged in to post a comment.