With us being just over a week into the New Year, we feel it worthwhile to look back just one last time at 2016. We believe that many of the themes and risks of 2016 continue in 2017 and that they are likely to impact markets in the coming months â especially the precious metal markets.

Malcolm McDowell as Alex in A Clockwork Orange. Source: Wikimedia

Malcolm McDowell as Alex in A Clockwork Orange. Source: Wikimedia

We always enjoy new perspectives and every year we enjoy the witty, comprehensive and insightful analysis review of the year past by David Collum. His‘2016 Year In Review’ is in the same vein and was missed by many when it was released over the Christmas period.

Collum is a professor of Chemistry and Chemical Biology at Cornell University. In addition to his academic interests, he authors an annual review of the financial, economic and geopolitical year. The review is a must read and includes interesting information about the astute academic’s views on gold â he is âsanguine as ever holding large precious metal positions.â

He continues:

âDespite weakness of late, the case for gold is now in place: European and Chinese banking risks, negative interest rates, a war on cash, and omnipresent risks of a hot war in the borderlands of the Middle East and Europe. Estimates suggest 0.3% of investors’ assets are in gold.77Â Traditional portfolio theory recommends 5%, offering a better than 15-fold relative performance en route. (Recall that discussion of âflowâ from above.)

Let’s check in on what some of the wingnuts on the fringe of society are chortling about now:

âThe world’s central bankers are completely focused on debasing their currencies. If investor’s confidence in central bankers’ judgment continues to weaken, the effect on gold could be very powerful.â

~Paul Singer, Elliott Management Corp

Gillian Tett: âDo you think that gold is currently a good investment?

Greenspan: âYes. Economists are good at equivocating, and, in this case, I did not equivocate.â

âI can understand why holding gold would seem to be a sensible part of a national portfolio. Because there is clearly a need to take some precautions against an unknowable future.â

~Mervyn King, former head of the Bank of England

âI am not selling gold.â

~Jeff Gundlach, DoubleLine and the new âBond Kingâ

âThe case for gold is not as a hedge against monetary disorder, because we have monetary disorder, but rather an investment in monetary disorder.â

~James Grant, Founder of Grant’s Interest Rate Observer

âEveryone should be in gold.â

~Jose Canseco, expert on performance enhancement

James Grant also went on to say that âgold is like a monetary tonsil,â leading some to speculate that his son, Charley (WSJ), slipped him a pot brownie. Let’s see if we can get the goofs too.

We’ll begin by blowing out a few ideas I do not subscribe to. I keep hearing from smart guys that gold is in short supply in the Comex or Shanghai gold exchange, you name it. These stories almost never play out. I am also a huge fan of Rickards and Maloney, but the saying âgold is moneyâ and the notion that its price is actually the movement of the value of the dollar don’t work for me: prices of everything I buy follow the dollar, not gold, on the currency timescales. On long timescales, their assertion may be correct. Someday their assertion may even be correct on short timescales, but that isn’t right now.

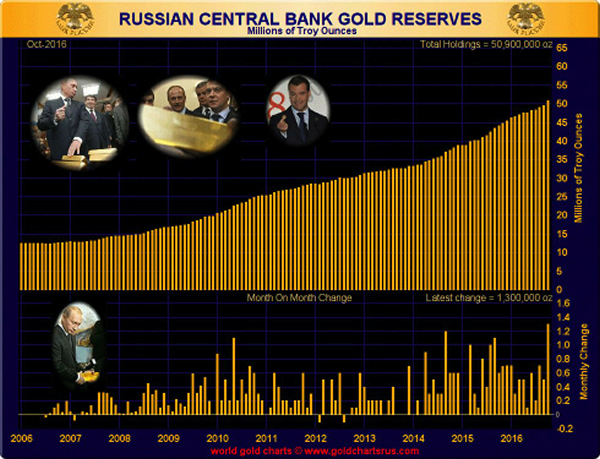

What a year: I got as many electoral delegates as the bottom ten republican candidates combined, ate python, and own as much gold as the Central Bank of Canada. Per the Bank of Canada, it finished selling off all of its gold,78 probably to ensure that the U.S. didn’t attack. You think I jest? A WikiLeaked e-mail by Sid Blumenthal to Hillary Clinton revealed that France whacked Libya to make sure North Africa distanced itself from a gold dinar currency.79,80 Germany supposedly has half of its requested gold repatriated from the U.S. and France,81 which could be bullish or bearish on the half-full/half-empty logic. Venezuela repatriated 100 tons of gold a few years ago and was squeezed to sell it all back in the heat of a currency crisis.82 The Dutch depatriated their gold this year after repatriating it not long ago.83 The reasons are unclear. Alexei Ulyukayev, first deputy chairman of Russia’s central bank, assured us Russia will continue to buy gold (Figure 7), presumably as a defense against interventions from inside the beltway. Of course, the Fed is silent on the âmetal whose name shall never be spoken.â

Figure 7. Russian gold reserves

In a shockingly quiet year given how much gold moved to the upside before the post-election monkey hammering, we probably should finish with some generic goofiness. On a few occasions, gold took the beatings that are familiar-huge futures dumps in the illiquid wee hours of the morning when no price-sensitive investor would ever consider selling. It dropped $30 in seconds late on the day before Thanksgiving when nobody was paying much attention. Another hammering came from a $2.25 billion sale84 and another $1.5 billion sale,85 both of which occurred in under 1 minute. Nanex concluded that the algo âgold spooferâ was at play,86 but the 2016 poundings were transitory and toothless compared with their brethren in 2011â2015. Trouble in the ETF market was revealed when BlackRock was overwhelmed by GLD buying.87 It was forced to create more shares in February than it had in a decade. I retain previously stated convictions that GLD is a scam-fractional-reserve gold banking. Deutsche Bank was overwhelmed by requests for physical gold.88 It tried to shake the hook by demanding that such a request must be made at a participating bank.89 Deutsche Bank, the location of the request, is not a participating bank? I imagine it doesn’t have the gold, consistent with its troubles outlined below. A Swedish precious metal vault got its payment mechanism terminated without explanation.90

We can’t close without talking about gold’s kissing cousin-silver. The silver market gets its share of muggings and sustained bashings, at times spanning several weeks. The silver sellers didn’t get full traction either, however, bringing silver off a 50% gain but leaving it up 15% year to date. Silver market treachery got some attention. The London Silver Fix-truth in advertising-at times deviated markedly from the spot price,91 causing consternation among those attempting to fix the price. Deutsche Bank agreed to settle litigation over allegations it illegally conspired with Scotiabank and HSBC Holdings to fix silver prices at the expense of investors.92 A class action suit against Scotiabank suggested that the conspiracy spanned 15 years.93 JPM was cleared of silver manipulation in three lawsuits-all dismissed with prejudice, an altogether different form of âfix.â94 The only remaining question is why they are stockpiling huge stashes of physical silver.95

I’m as sanguine as ever holding large precious metal positions. Gold bugs are reminded, however, of what a big victory will feel like:

âOur winnings will come . . . from the people who wake up one morning to find their savings have been devalued or bailed-in. . . .

[I]t’s going to come from the pension funds of teachers and firefighters. The irony is that when gold finally pays off, it will not be a cause for celebration.â~Brent Johnson, Santiago Capital

‘2016 Year In Review â A Clockwork Orange’ can be accessed in full here

KNOWLEDGE IS POWER

For your perusal, below are in order of downloads our most popular guides in 2016:

10 Important Points To Consider Before You Buy Gold

7 Real Risks To Your Gold Ownership

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold and Silver Bullion â News and Commentary

Gold edges up, but gains limited by rate hike prospects (Reuters.com)

Gold slips from one-month high after U.S. data; palladium soars (Reuters.com)

Factory orders tumble 2.4% in November (MarketWatch.com)

Bitcoin extends losses, slides another 12 percent on China warning (Reuters.com)

CME Group average daily metals trading volume up 34% in 2016 (Platts.com)

Gold, Trump and Politics In The Time Of Twitter (DailyReckoning.co.uk)

Summers Warns of Financial-Crisis Risk From Trump Economic Plans (Bloomberg.com)

There Is No Limit On Holding Gold: Managing Director, India, WGC (OutLookIndia.com)

JP Morgan’s COMEX Silver Stash Tops 83 Million Troy Ounces (GoldSeek.com)

Will this bull market end with a whimper â or a catastrophic bang? (MoneyWeek.com)

Gold Prices (LBMA AM)

09 Jan: USD 1,176.10, GBP 968.75 & EUR 1,118.59 per ounce

06 Jan: USD 1,178.00, GBP 951.35 & EUR 1,112.27 per ounce

05 Jan: USD 1,173.05, GBP 953.55 & EUR 1,116.16 per ounce

04 Jan: USD 1,165.90, GBP 949.98 & EUR 1,117.40 per ounce

03 Jan: USD 1,148.65, GBP 935.12 & EUR 1,103.28 per ounce

30 Dec: USD 1,159.10, GBP 942.58 & EUR 1,098.36 per ounce

29 Dec: USD 1,146.80, GBP 935.56 & EUR 1,094.85 per ounce

Silver Prices (LBMA)

09 Jan: USD 16.52, GBP 13.57 & EUR 15.69 per ounce

06 Jan: USD 16.45, GBP 13.30 & EUR 15.54 per ounce

05 Jan: USD 16.59, GBP 13.47 & EUR 15.80 per ounce

04 Jan: USD 16.42, GBP 13.36 & EUR 15.74 per ounce

03 Jan: USD 15.95, GBP 12.97 & EUR 15.34 per ounce

30 Dec: USD 16.24, GBP 13.20 & EUR 15.38 per ounce

29 Dec: USD 16.06, GBP 13.10 & EUR 15.36 per ounce

Recent Market Updates

â Gold Gains In All Currencies In 2016 â 9% In USD, 13% In EUR and Surges 31.5% In GBP

â Trump’s Twitter â140 Charactersâ To Push Gold To $1,600/oz in 2017?

â 2017 â The Year of Banana Skin

â US: Five Must Gold See Charts â Gold Miners Are âRunning Outâ of Gold

â Royal Mint And CME Make A Mint On The Blockchain?

â China Gold and Precious Metals Summit 2016 â GoldCore Presentation

â Trumpenstein ! Who Created Him and Why?

â Bail-Ins Coming? World’s Oldest Bank âSurvival Rests On Saversâ

â Fed’s âFool Meâ¦â, Silver Suppression, Euro Contagion In 2017?

â Fed Raised Rates 0.25% â Rising Rates Positive For Gold

â Shariah Gold Standard Is âRevolutionaryâ â Mobius

â Silver Fixing By Banks Proven In Traders Chats

â Euro Crisis and Contagion Coming In 2017

The post 2016 Past is 2017 Prologue appeared first on GoldCore Gold Bullion Dealer.

Leave A Comment

You must be logged in to post a comment.